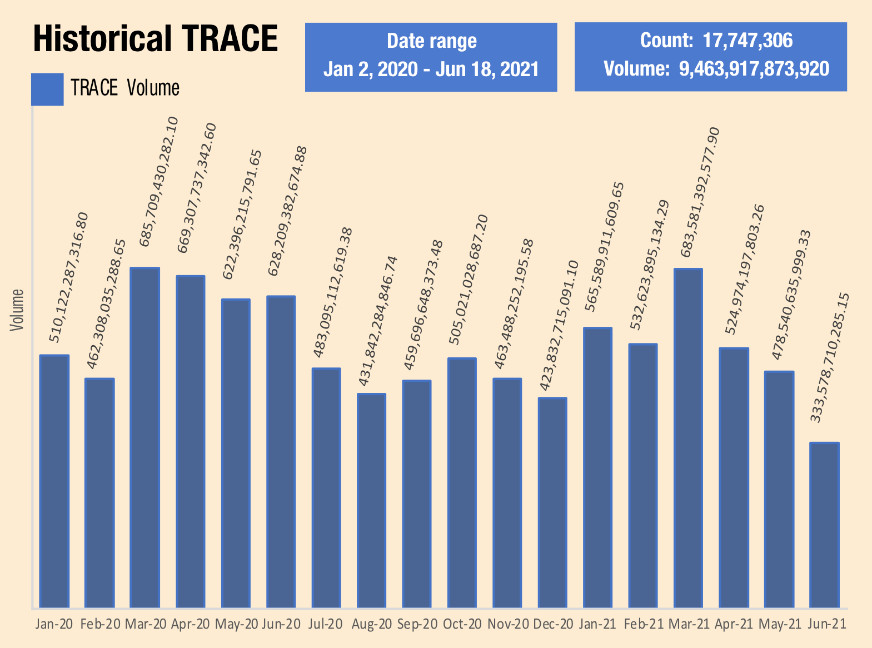

Volumes in US investment grade (IG) bonds have fallen significantly in the second quarter of this year compared with the same period in 2020. The underlying causes of market volatility last year – the Covid pandemic and an oil price war – appear to have retreated, which make for a more stable backdrop to the market.

This potentially does not bode well for investment banks seeking to replicate their revenue successes from last year. Banks who saw Q1 revenues increase year on year including JP Morgan (up 15% for fixed income) and BAML (up 22% for FICC), with credit being a major factor, found returns stated to normalise in March.

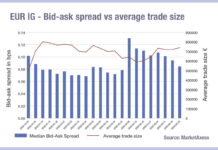

We have seen spreads reduce – as noted in the last Barnes on Bonds – which is an indicator that liquidity conditions overall are worsening.

Buy-side traders will need to carefully assess how to execute trades into the market in this environment. Lower volumes will not affect all CUSIPs equally. Market impact and block availability will be adversely affected for some issuers and sectors more than for others.

Getting a granular picture of liquidity pre-trade will be increasingly important in order to minimise these effects and to increase the chances of finding the right counterparty for executing large-in-scale trades.

There will potentially be fewer relative value trades available as inventories are held on to. Accessing primary issuance of bonds will be a key source of liquidity as secondary trading volumes reduce.

Finding the right trading protocol will be imperative for most buy-side desks. Accessing natural liquidity in all-to-all trading, and using negotiated protocols such as portfolio trading, will undoubtedly increase the efficiency of trading. If trade sizes are declining the potential to automate smaller, lower-touch trades will also be advantageous.

However, data will once again be paramount. Lower trading volumes equals less pricing data and that makes pre-trade assessment of investment opportunities harder. Any automated trading or price making will hinge upon the ability to benchmark prices against the wider market. A combination of composite and multiple pricing inputs will deliver real results to traders in this environment and that will pay-off in the quality of execution they can achieve.

©Markets Media Europe 2025