If you are on the desk, there is often an inverse relationship between the tension you experience and the volume of people relaxing on holiday.

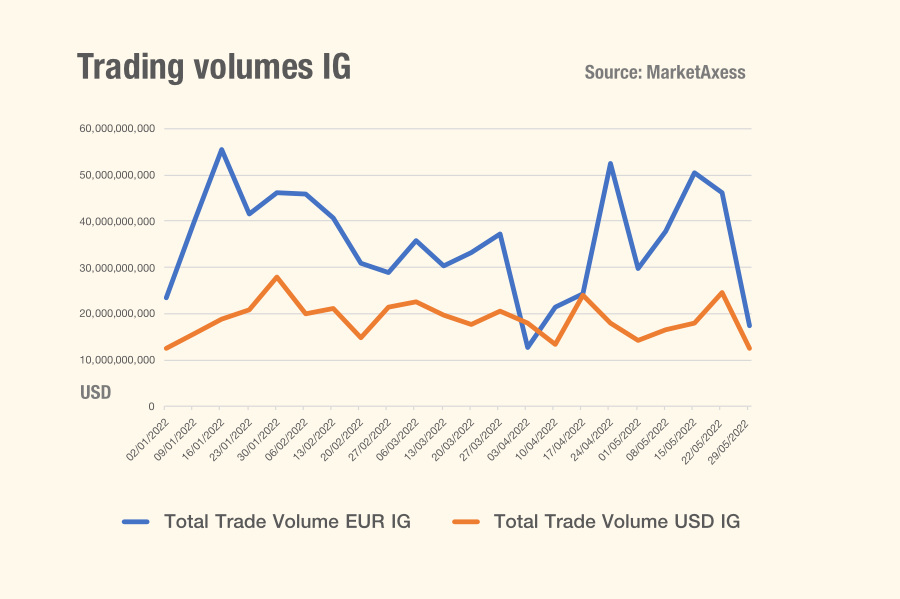

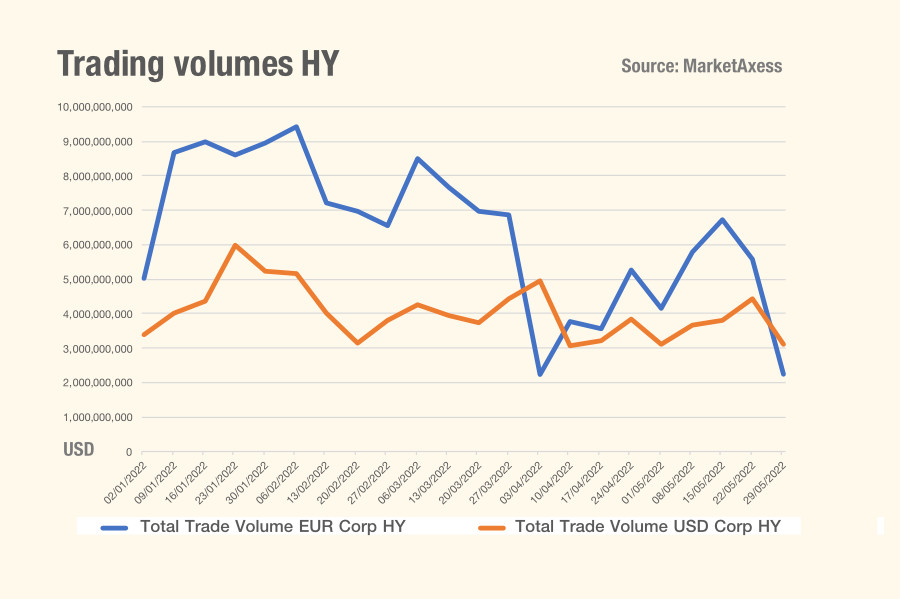

For example, European bond trading volumes were nearly cut in half during the last week of May, according to MarketAxess data, for both investment grade and high yield. That stood in contrast to volumes in the US. Anecdotally, we hear that liquidity has been very difficult to find, with traders noting that expressing investment ideas in the bond markets has been very challenging.

The cause of this sudden drought is likely to be a confluence of several factors and a major, perhaps surprising element, is the holiday season, signalling a proverbial liquidity bears’ picnic.

Late May and early June had high volume of traders going on leave; Ascension Day in Europe on 26 May, Memorial Day on 30 May in the US, with the UK celebrating the Queen’s Jubilee on 2 and 3 June, all led to extended weeks off for trading desks and portfolio management teams.

In apprehension of this, some firms will have been keen to compress their books with activity trailing off, and other will have been harder pressed to find a counterparty to engage with.

Volumes were not only affected by the holiday season. The lack of primary issuance in bond markets has reduced turnover of portfolios as supply dries up. Despite the appetite for higher yielding assets, issuer appetite for offering more debt has fallen in the face of increased borrowing costs.

Combined with price volatility as a response to rate changes, these holidays were far from relaxing for trading desks, particularly in Europe.

©Markets Media Europe 2025