Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European credit, the average ticket size for automated trades has grown year-on-year, and we are also seeing average trade sizes grow in RFQ and PT trading,” says Liane Fahey, head of European institutional credit, at Tradeweb. “On top of that, we are seeing overall volumes grow.”

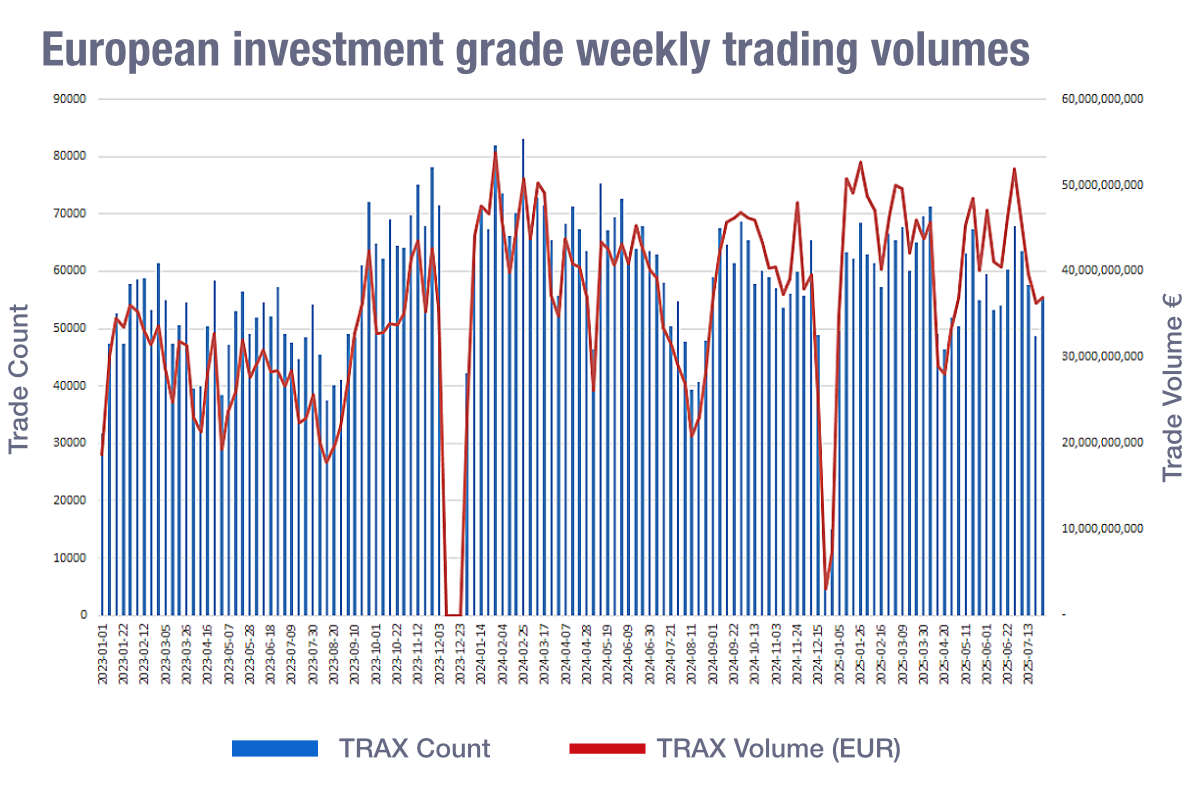

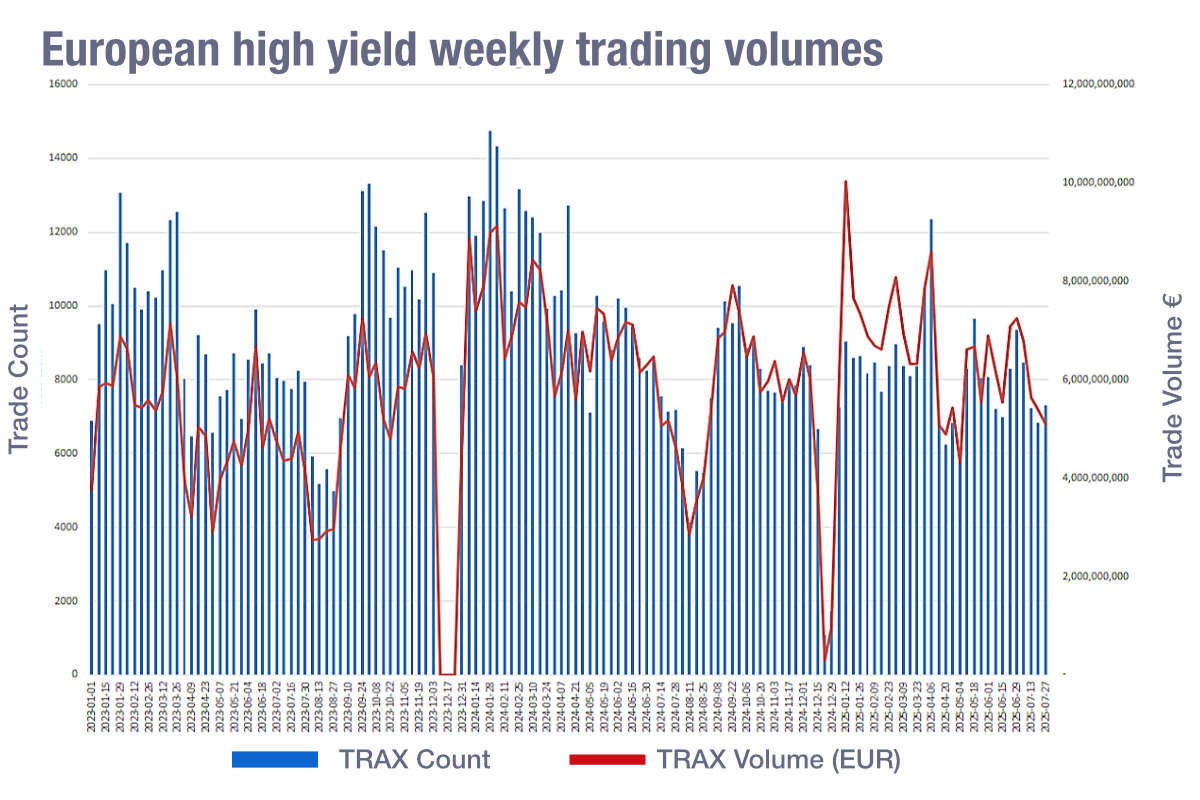

Looking at data from MarketAxess TraX, which measures activity across multiple marketplaces, it is clear that while total market volumes and trade counts have fallen over the past year in high yield, and grown in investment grade, trade count is not keeping up with notional traded.

Digging into the number, in 2025 the average trade size in Europe, year-to-date, is €719k for investment grade (IG), up 15% from €626k YTD in 2024 and up 28% on the €560k YTD seen in 2023.

In high yield (HY), average trade size in 2025 YTD for HY is €808k, up 20% from €673k YTD in 2024 and 46% up on the €553k YTD average trade size in 2023.

If trades are becoming more electronic and larger, this flies in the face of bond market ‘equitification’ – the idea that bond markets are following the pattern of trading seen in equity markets. Equity markets are characterised by increasingly electronic, automated and smaller trades. Bond markets are reverting to type, favouring larger risk transfers over shorter periods of time – where possible.

Platform analysis

Electronic trading platforms providers report that the growth of electronic trading protocols is outpacing that of overall bond trading volumes, which are flattish in IG to falling in HY.

“The fastest growing protocol we have is automation,” says Gareth Coltman, head of trading solutions, EMEA and APAC at MarketAxess. “It is a layer on top of other protocols, which still continues to significantly outpace any other way that clients interact with our platform.”

He also notes that portfolio trading has increased considerably, a fact supported by analysis published in June by Barclays’ head of Thematic Fixed Income Research, Zornitsa Todorova.

“Volumes in March and April 2025 hit record highs of €35 billionn across 800 portfolio trades each month,” she wrote. “Activity was led by euro-denominated IG bonds, which accounted for over €20 billion of monthly volume and a 14% market share as of April. But the strength was not limited to euros – sterling-denominated bonds also saw standout growth, with PT volumes nearly doubling and accounting for 21% of dealer-to client activity. Our analysis attributes this surge to increased activity from pension funds and real money investors, alongside passive flows concentrated around month-end as index rebalancing tends to drive portfolio trades.”

That balance of trading counterparties is also reflected across trading protocols, says Tradeweb’s director of data science, Gio Accurso, as intra-month trading has increased in volume,

“This points to the growth of actively managed funds who are trading and finding opportunities in the volatility,” he says. “That is also affecting the segments we’re seeing traded, and in July, we had a record for high yield European credit trading. As markets are bouncing back, high yield is a strong segment to speculate with for actively managed funds, because it offers higher potential returns. So clients are doing more with these protocols, and they’re being potentially more speculative in trading. That means so far there is no obvious pattern to the intramonth trading, but rather follows the volatility, as and when it emerges.”

Coltman adds, “On the sell side, dealers have increased the size they’re willing to quote on algos significantly. It is not uncommon at all now to see sizes of €5 million. Clients are beginning to track their own automation size settings in-line with this activity. In the US we’ve seen some dealers quoting up to US$10 million on algos. This trend will continue as those algos get proven out.”

However, James Dale, co-head of international developed markets at Tradeweb, observes that automation in Europe has a greater uptake and adoption in credit than in the US, so it may overtake the US market in the long term.

“We’re seeing the largest sizes ever being automated in that manner, where historically clients would have used it just for their low touch, low effort trades,” he says. “We’ve seen tickets of up to €10 million being traded in a completely automated, end-to-end fashion.”

Although each protocol offers a different model of execution, Coltman notes that there is a common thread of increased efficiency is driving adoption by clients.

“Trading desks have more orders and activity to manage, in the most efficient and data driven way possible,” he says. “Using automation to approach the market on a line by line, order by order basis, allows them to control that interaction. Approaching the market in one large interaction, as with a portfolio trade, gives a complete execution, but both yield similar outcomes in terms of efficiency by saving time.”

E-trading battle heats up ahead of transparency launch

The battle for market share in European electronic trading is fiercely contested, as in other markets. Yet new offerings continue to emerge, and compete on trading models and price.

“We will be introducing portfolio trading in November, and that really does support our credit efforts,” says Angelo Proni, CEO of MTS. “This product is an integral part of the dealer-partnership initiative that we kicked off in September last year, supporting an exceedingly competitive price point, and we already have six dealers who are beginning to factor in those commercial benefits in the way they price, which should get a real boost through portfolio trading.”

Playing to the strengths of liquidity providers, and supporting their weaker points, is expected to draw liquidity onto the MTS Bond Vision platform.

“We’ve also introduced targeted firm streams, allowing a dealer to stream firm prices by API to their clients in a very customised manner,” he says. “They can tailor quotes and sizes to the single instrument and user on the other side. That capitalises on our order book technology and the fact that, when it comes to latency, we’re second to none. It’s venue centric direct connectivity without the time to market of direct connectivity and with scalability.”

In Europe and the UK, consolidated tapes (CTs) are expected to become operational in 2026, allowing a common feed of post-trade reporting of European bond trades. When this additional transparency comes into effect it will inevitably create new opportunities says Chris Murphy, founder and CEO of Ediphy, the firm selected to run the European consolidated tape.

“We would expect to see smaller clip sizes, more tickets, and midpoint auction type protocols develop,” he says. “The CT has a role to play as, with more price transparency, people have more confidence in the midpoint, whether it’s an evaluated midpoint, or directly from trading on the CT. Electronic trading activity produces more data to then feed trading.”

There are lessons from US markets, which has had a similar tape for over two decades, Murphy notes, indicating how new models of trading might develop.

“The central limit order book (CLOB) type markets in the US have no real equivalent in Europe,” he observes. “We’re likely to see a section of the market with more retail CLOB-type activity, as we start to get more transparency from the tape. When there’s enough natural two-way flow you can start to converge around a CLOB. Secondly, that price information can also help with price formation. It will bring in more alternative market makers into this space. You’ve got the link with portfolio trading and also exchange traded fund (ETF) providers. That virtuous circle will evolve.”

As equities trade on central limit order books this development would be some way to increase equitification of bond markets, however such activity is limited even in the US.

The current direction of travel appears to support the idea that as traders become more accustomed to trading in larger sizes on new protocols, order sizes will keep expanding.

“Clients are more willing to use PT for much larger sizes,” Coltman says. “It is more common for clients to include block sizes in their PT versus RFQ. For us in Europe, we’ve seen significant growth in clients trading individual lines of blocks as well using small group RFQ or trading directly with one dealer. Generally, clients have an appetite to trade in larger size using electronic tools.”

©Markets Media Europe 2025