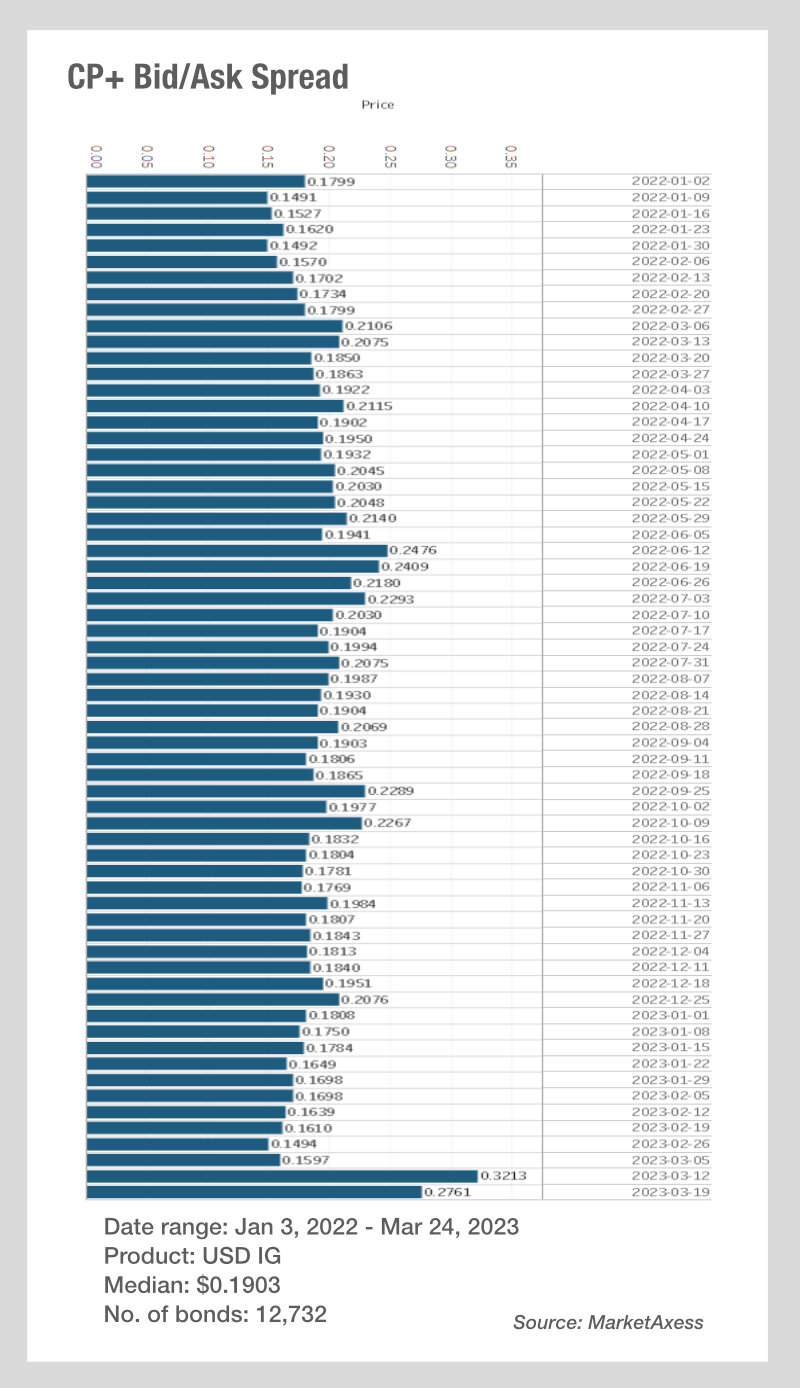

Bid-ask spreads have widened massively in recent weeks, according to MarketAxess CP+ data, with the price in US investment grade nearly doubling in the week of 12 March, after Silicon Valley Bank’s collapse.

Bid-ask spreads have widened massively in recent weeks, according to MarketAxess CP+ data, with the price in US investment grade nearly doubling in the week of 12 March, after Silicon Valley Bank’s collapse.

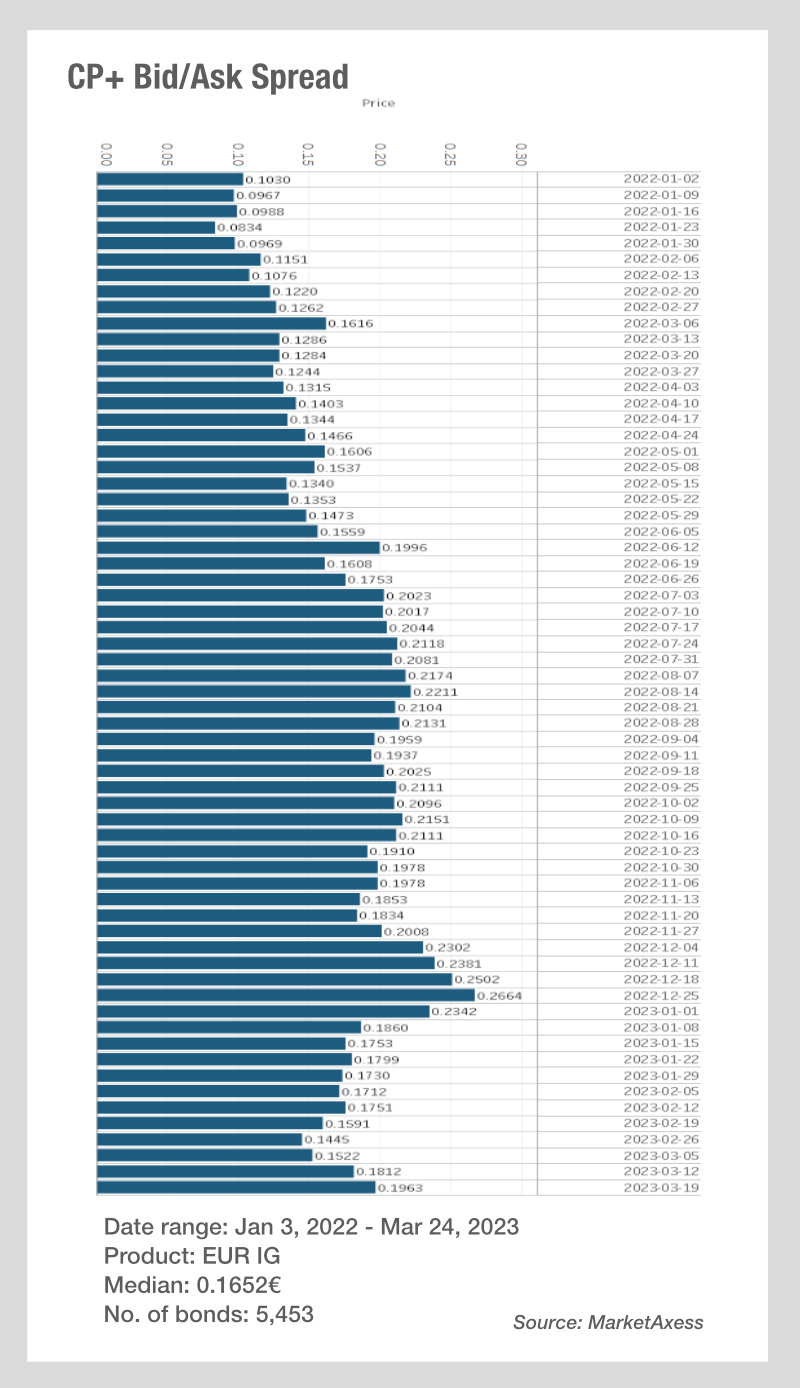

Looking at European markets available data up to 19 March shows that bid-ask spreads were rising in anticipation of the Credit Suisse problems although still lower than at year end in 2022, and did not show the same shock jump that the US experienced.

Anecdotally, traders have confirmed that problematic issues for desks over the past week have been very much around high trading volumes masking a lack of liquidity, which was seen in the blow-out of spreads. There was very little liquidity at the touch in future markets and the depth of book had fallen considerably compared with historical norms.

Price volatility made it very challenging for investment banks to make markets leading them to widen spreads to cover their risk, while simultaneously a lot of directional, bilateral trading was being done via direct dealer -to-client (D2C) channels.

Price volatility made it very challenging for investment banks to make markets leading them to widen spreads to cover their risk, while simultaneously a lot of directional, bilateral trading was being done via direct dealer -to-client (D2C) channels.

With most markets professionals looking for the next ‘domino’ to fall and uncertainty even around the legality of the rescue imposed upon the Swiss market for Credit Suisse in question, the current pause in vol may be temporary. Relationships have once again proven invaluable in market making with concern voiced about onscreen prices being posted by some banks, however, the evolution of the market has given a new generation of traders equipped with a more data-led, electronic approach to trading than their older peers their first taste of real volatility.

©Markets Media Europe 2023

©Markets Media Europe 2025