MARKET NEWS

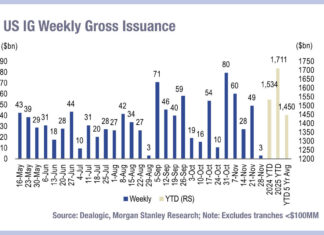

US credit volumes jump YoY

US corporate bond trading is expecting to reach record levels in 2025, according to a recent Coalition Greenwich report.

In November, average daily trade sizes...

US rates e-trading stabilises

Electronic trading in US rates dropped by five percentage points year-on-year (YoY) but rose by two percentage points month-on-month (MoM), representing 57% of total...

ETS confirms CTP go-live as Ediphy’s legal battle drags on

Etrading Software has set 22 June 2026 in stone as its go-live date for the UK’s bonds consolidated tape.

“This is the earliest date that...

Carmalt joins ING in UK DCM push

David Carmalt has joined ING as head of investment grade (IG) debt capital markets (DCM).

Based in London, Carmalt reports to head of the EMEA...

Competition in US Treasury clearing could sustain vicious exchange battle

The bitter competition between FMX and the CME, for trading of US Treasuries and Treasury futures, could enter an accelerated phase as new clearing...

Euronext seeks govies clearing expansion

Euronext Securities Milan has requested LCH open the settlement of all its European government bonds as Euronext seeks to align the services of its...

FEATURES

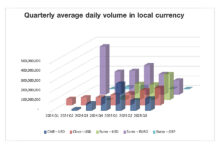

Credit futures see OI and ADV increase more than sevenfold YoY

The adoption of credit futures as a mainstream credit trading vehicle is broadening across venues and currencies: US$ iBoxx total return based futures traded...

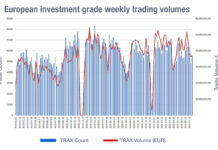

Trade size growth undercuts European bond market ‘equitification’

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Declaration of dependence

US president to oversee financial institution regulation amid deregulation drive.

Executive orders signed by US president, Donald Trump, have given him oversight of all US...

PROFILES

RESEARCH

Bond traders predict data science/AI use explosion in 2026

The DESK’s Corporate Bond Liquidity Access Survey, supported by LTX, finds trading desks are on the cusp of change.

Buy-side traders see 2026 as a turning...

Subscriber

Credit Spotlight

FROM THE ARCHIVES

The Fed and BlackRock’s bond-buying criteria challenged

Detail around the Primary Market Corporate Credit Facility (PMCCF) and Secondary Market Corporate Credit Facility (SMCCF) launched by the Federal Reserve Bank of New...

Dom Holland joins LedgerEdge

LedgerEdge, the distributed ledger ecosystem for corporate bond trading, has appointed senior fixed income specialist Dom Holland to the role of business development for...

Brambilla swaps Morgan Stanley for Citi

Silvia Brambilla has joined Citi as a financials credit trader. She is based in London.

Citi reported US$4.3 billion in fixed income markets revenue for...

Sherpa Edge announces client go-live after summer; Lynge Jensen departure

Danish-based outsourced trading provider, Sherpa Edge, has confirmed it is in final negotiations with its first customer, a Danish asset manager, with which it...

Exoé signs Sherpa Edge Trading as linked agent in Northern Europe

Sherpa Edge Trading is entering into a linked agent agreement with outsourced trading provider Exoé. This partnership will bring Exoé’s buy-side outsourced multi-asset trading...

Beyond Liquidity: Automation a key theme in fixed income

Automation was one of the most discussed themes at this year’s Fixed Income Leaders’ Summit in Barcelona, which took place earlier this month, with...

MarketAxess’s Axess All Prints to offer real-time price transparency in Europe

Fixed income market operator and data provider, MarketAxess, has launched Axess All Prints, a real-time transacted price service for the most actively traded fixed...

Platforms: What the winners are doing right

A few platforms have consistently gained buy-side confidence over the last five years, through smart assistance and simplification of trading workflow.

The three ‘O’s of...

Lagarde: Capital Markets Union is failing, calls for European SEC to combat national interests

In a speech to the European Banking Congress in Frankfurt on 17 November 2023, Christine Lagarde, president of the ECB, has said the transition...

FCA fines three broker firms £4.7 million market abuse failures

The Financial Conduct Authority (FCA) has fined interdealer brokers BGC Brokers, GFI Brokers and GFI Securities £4,775,200 for failing to ensure they had appropriate...

ESMA’s CTP selection process begins

ESMA has initiated the selection process for the European bond consolidated tape provider (CTP).

Potential candidates must submit requests to participate in the first selection...

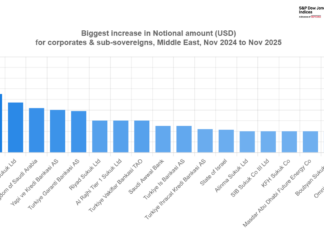

IHS Markit and CBPC open up China’s bond market with new onshore indices

By Shobha Prabhu-Naik.

Business information provider IHS Markit has launched new onshore Chinese bond market indices, which it claims are the first international, independent fixed...