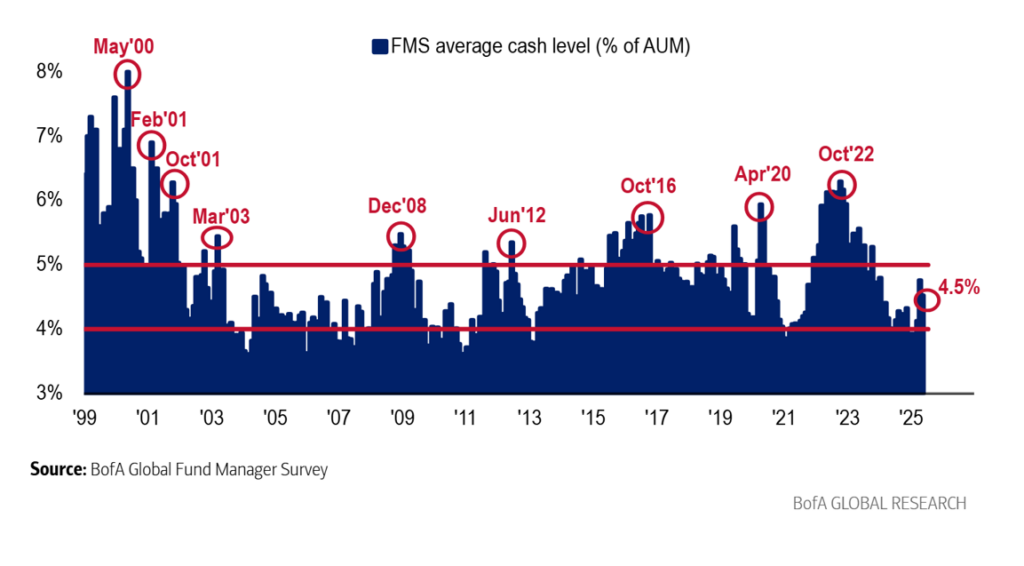

The Bank of America Global Fund Manager Survey (FMS) has seen the scaling back of US-China tariffs as a net positive for activity. In its latest research, 75% of the FMS was completed before announcement of US-China talks, and investor sentiment was glum, especially on US assets. For responses in May to the FMS it was not as extreme as “uber-bearish” previous responses, seeing recession as less likely, cash levels cut to 4.5% from 4.8%, major tech reallocation, but bearish enough to suggest pain trade modestly higher given positive US-China trade war ceasefire and preventing a recession or credit event.

On the macro side, investors were less pessimistic with 59% expecting weaker global growth vs 82% in April. Only 1% thought a recession was likely vs 42% in April, with a soft landing back as consensus outlook for 61%, a hard landing at 26%, and no landing 6%.

Respondents expected the final US tariff rate on China exports would be 37%, with a trade war as seen as the primary tail risk and the most likely source of credit event. Between two and three cuts by the Federal reserve is expected in 2025 by two thirds of investors.

Investors are the most underweight on the US dollar since May 2006, have slashed big bond overweight to neutral, and said gold is most overvalued in 20 years with long gold seen as the most crowded trade. They have also trimmed global equity underweight positions via European rather than US stocks, which are the most underweight since May 2023.

Looking ahead if there is a “no landing” scenario this will be most positive for US stocks, emerging markets small cap and energy while being negative for gold. If there is a “hard landing” it will be most positive for health care and negative for the Eurozone and banks.

©Markets Media Europe 2025