MARKET NEWS

China considers alignment with global repo standards

The People’s Bank of China (PBOC) is planning to further open up its bond repo market for overseas institutional investors, potentially adopting the International...

Quantum leap: HSBC, IBM improve bond RFQ fill rate by 34%

HSBC and IBM have reported a 34% improvement in fill-rate modelling for bond request-for-quote (RFQ) using quantum-generated features and common data science algorithms.

The bank–technology...

RBC Capital Markets boosts European leadership

RBC Capital Markets has expanded its European flow rates trading team, naming Ian Hale as head of European inflation trading and promoting Callum Maitland...

Breaking: Ediphy challenges FCA award of bond CTP to eTrading Software

The UK Financial Conduct Authority has received a legal challenge from Ediphy to its decision to award the contract for the UK bond consolidated...

Euronext’s European govie mini-futures go live

Euronext has launched its mini-futures for European government bonds.

The products focus on the 10-year OAT, Bund, Bono and BTP. They also cover the first...

SMBC Group to provide US$2.5bn credit facilities to Jefferies

Sumitomo Mitsui Banking Corporation (SMBC) Group is providing Jefferies with approximately US$2.5 billion in new credit facilities as the firms develop their global strategic...

FEATURES

Credit futures see OI and ADV increase more than sevenfold YoY

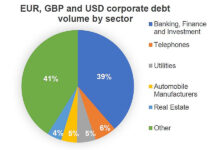

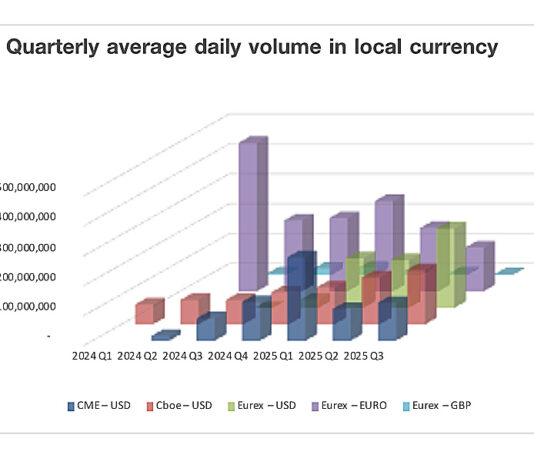

The adoption of credit futures as a mainstream credit trading vehicle is broadening across venues and currencies: US$ iBoxx total return based futures traded...

Trade size growth undercuts European bond market ‘equitification’

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Declaration of dependence

US president to oversee financial institution regulation amid deregulation drive.

Executive orders signed by US president, Donald Trump, have given him oversight of all US...

PROFILES

RESEARCH

Bond traders predict data science/AI use explosion in 2026

The DESK’s Corporate Bond Liquidity Access Survey, supported by LTX, finds trading desks are on the cusp of change.

Buy-side traders see 2026 as a turning...

Subscriber

Credit Spotlight

FROM THE ARCHIVES

Discussions between TP ICAP and Neptune reported

Multiple market sources have reported that discussions between pre-trade data provider Neptune and TP ICAP, the multi-asset trading, interdealer broker and data services firm,...

Investor Demand: Geopolitical risk an evolving threat, but not discouraging risk taking

Geopolitical risk is top of mind for institutional investors, with close to 50% saying that there are too many in play for them to...

Handelsbanken Fonder AB adopts Bloomberg’s PORT Enterprise

Handelsbanken Fonder AB, a subsidiary of Handelsbanken managing approximately 100 mutual funds, has adopted PORT Enterprise, Bloomberg’s portfolio and risk analytics solution, to further...

“Complete misunderstanding … or try[ing] to baffle people”; Lutnick counters Duffy

BGC Group’s Q2 earnings call this week wasted no time at all before addressing the ongoing spat between CEO Howard Lutnick and CME CEO...

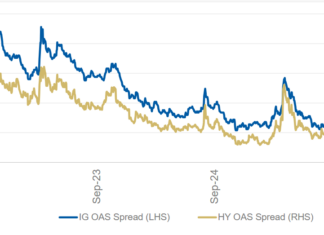

Is the market braced for another sell-off?

Traders are reporting the positive effects of innovation upon market liquidity but central banks hold all the cards.

The association between the Covid 19 pandemic...

ICE begins exchange offer for outstanding unregistered 3.625% senior notes

Intercontinental Exchange (ICE) has begun the exchange offer for its outstanding unregistered 3.625% senior notes, due in 2028. They will be exchanged with equivalent...

Broadridge’s LTX completes integration with Charles River Development

LTX, Broadridge Financial Solutions’ artificial intelligence (AI)-driven digital trading platform, has completed a successful integration with the Charles River Investment Management Solution (Charles River...

Derivatives : Exchange-traded products : Joel Clark

Why listed derivatives struggle to address risk

Some traders have been critical of listed products designed to replicate OTC derivatives, but exchanges are working hard...

Surveillance is only as good as the data that fuels it

Passing the test on market abuse regulatory obligations will increasingly mean being “data fit”

By Anthony Belcher, Head of EMEA, ICE Data Services

When market...

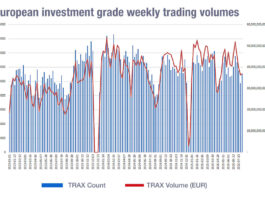

April saw European bond volume dip

Data from MarketAxess has indicated that trading across bond markets in Europe dipped in April, with European sovereign trading volumes dropping after a period...

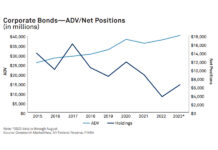

Hold me now!

“Hold me now,

Whoa, warm my heart,

Stay with me!”

This Thompson Twins’ classic could be sung by corporate bonds to the sell-side community, who saw their...

US electronic platforms’ credit activity cools further in

Average daily volume reported on TRACE for US investment grade (IG) and high yield (HY) dropped a further 9% month-on-month (MoM) in June to...

![“Complete misunderstanding … or try[ing] to baffle people”; Lutnick counters Duffy “Complete misunderstanding … or try[ing] to baffle people”; Lutnick counters Duffy](https://www.fi-desk.com/wp-content/uploads/2023/05/Howard-Lutnick_214A_Cantor_900x600-218x150.jpg)