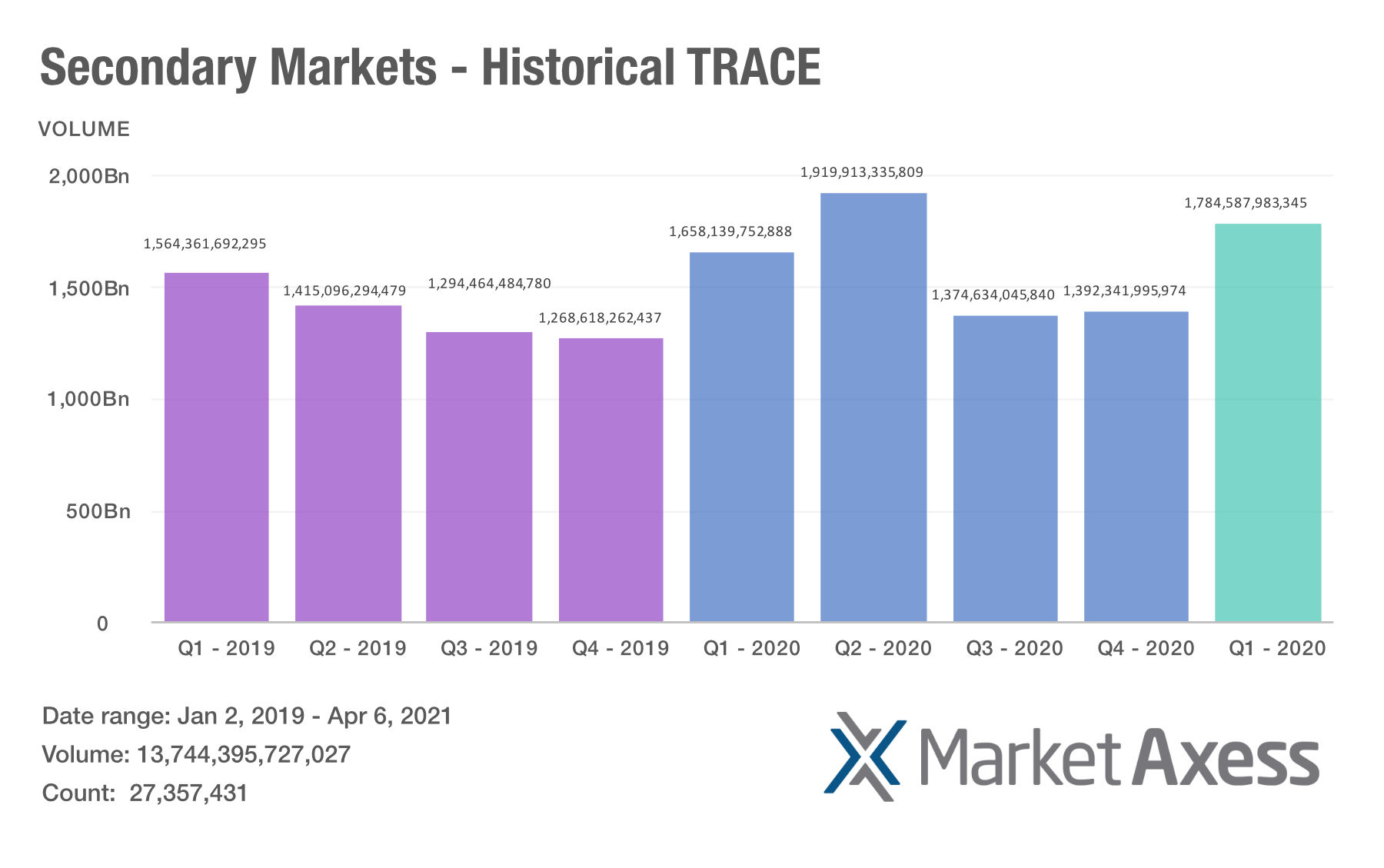

The first quarter of 2021 saw record volume in US and European investment grade trading volume. This is surprising on several fronts, with significant implications for buy-side trading desks.

The first quarter of 2021 saw record volume in US and European investment grade trading volume. This is surprising on several fronts, with significant implications for buy-side trading desks.

The first surprise is the higher volume in March 2021 compared with March 2020 as it is not being driven by the sell-off which characterised the market early last year, triggered by an oil trade war and the economic impact of COVID 19 restrictions hitting home. That means the activity is not highly directional, it is more balanced buying and selling activity, which needs a more careful analysis to unpick. Although price moves may not be as extreme – volatility is lower – opportunities exist to find alpha.

Secondly, we have seen higher levels of trading across January (US$565 billion) and February (US$532 billion) in 2021 where the tail end of 2019 and early 2020 was relatively quiet, with January topping out at US$510 billion. Despite the reported reduction of risk appetite amongst dealers in last year’s sell-off, the picture this year is of solid liquidity in the market. E-trading has been increasing as a longer-term trend and the capacity to access liquidity from multiple counterparties, including both traditional dealers and alternative liquidity providers, is widely cited amongst buy-side trading desks as key pillar of trade execution.

Third, block trading activity is higher in Q1 2021 than in 2020, with the volume traded in the US up from US$801 billion in Q1 2020 to US$860 billion this year for the first quarter. That shows market makers have increased their risk appetite, after a year in which they delivered record trading revenues.

For heads of trading at asset management firms, several points arise. If electronic trading is now delivering on its promise of additional liquidity in the market, they should assess building connectivity to the sources of that liquidity in order to achieve best execution for their investors. The greater volume seen in the market implies that there will be more nuanced opportunities to seize alpha, making analytics more valuable in the current environment if they allow traders and portfolio managers to look at relative value trades, or arbitrage opportunities.

The other implication of larger market volume is that trading desks can justify greater investment in automation of trading. Manual activity in such a market reduces the capability to seize opportunities when they arise, and without the right level of data being streamed to traders in such a way that it creates a clear picture of pricing and liquidity, traders can be disadvantaged.

©Markets Media Europe 2025