Trading efficiency has driven down the costs of trading, and supported the ability to find liquidity, despite falling volumes, says BondWave’s Paul Daley, MD for the Fixed Income Lab.

Having reviewed trading trends in the US fixed income markets through the lens of BondWave’s Quarterly Universal Prevailing Market Price (UPMP) Dashboards, according to the firm’s calculations, fixed income trade counts continue to fall in the third quarter, where total trades were down across all asset classes relative to the second quarter:

• Corporate trades – down 9.76%

• Municipal trades – down 9.99%

• Agency trades – down 11.60%

• 144A trades – down 10.62%

Average trade size also shrunk since par traded was down greater than trades relative to the second quarter:

• Corporate par traded – down 11.72%

• Municipal par traded – down 10.41%

• Agency par traded – down 15.78%

• 144A par traded – down 13.11%

“Volume just keeps sliding,” says Daley. “It is tough to compare with 2020, there was a huge volume spike, but if you roll back to 2019 [volume] is down a little. Ironically, as far as the ability to get trades done goes, I would say it is better than it has ever been. Trade costs are down. Usually, you think of those two things being positively correlated, but to me there is this fundamental long-term trend with trade costs shrinking – 2020 being an exception. However, that quickly reverted over the course of six months or so. It is not harder to get trades down even though volumes are down.”

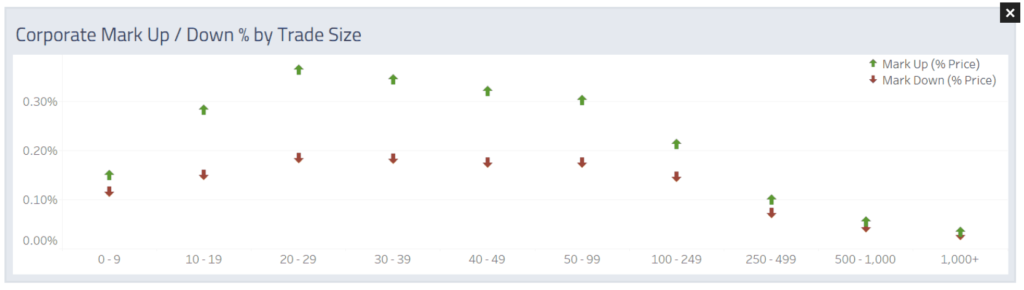

Data from MarketAxess has shown that bid-ask spreads have fallen, and BondWave’s own data shows the mark-up and mark-down on bonds has dropped in Q3 relative to Q2.

BondWave calculates up to eight pricing benchmarks for every customer trade disseminated by FINRA and the MSRB for asset classes requiring mark-up disclosure dating back to 2018. With this, it began producing dashboards for corporate, municipal, agency, and 144A bonds.

Daley ascribes the paradox of falling volumes and stable liquidity to increased market efficiency, based on automation and new ways of doing business.

“Some of that is new entrants into the market, new types of liquidity providers competing for liquidity. There is a greater supply of firms willing to provide liquidity so even though volumes are down, bid-offer spreads are tighter, mark-ups and mark downs are tighter. Slippage on trades is way down too.”

©Markets Media Europe 2025