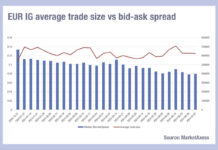

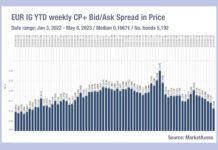

Europe’s incongruous drop in IG bid-ask spreads

European investment grade (IG) credit traders will have seen average bid-ask spreads declining since April, with the median average (typically about €0.03 cents lower...

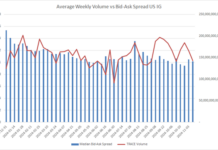

US markets seeing risk implied in bid-ask spread

While US stock markets are in turmoil, US investment grade bond markets are also reflecting the greater uncertainty caused by an erratic approach to...

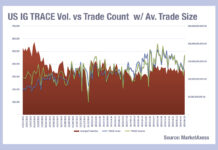

The high impact of low volumes in Q2

Volumes in US investment grade (IG) bonds have fallen significantly in the second quarter of this year compared with the same period in 2020....

Breaking blocks

Electronic trading is certainly on a growth spurt – Coalition Greenwich reports e-trading was 46% volume across all assets in 2021 – but this...

Visualising aggressive pricing pressure on trading costs

Analysing year-to-date volume and trade number data from MarketAxess’s TraX database for US credit, and correlating it with the weekly average MarketAxess CP+ bid-ask...

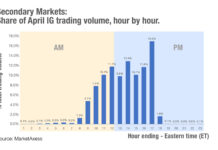

Chart of the week: When trading into the US, when should I trade?

Timing is everything in the markets, but not every market shares the same timing. It is common for trading desks to employ a trader...

Electronification of US credit delivers resilience

The electronification of the US corporate bond markets has demonstrated that its improved efficiency has strengthened depth of liquidity provision, rather than made it...

Upping strike rate and strength in US IG

We often hear ‘nothing really changes’ in relation to capital markets so it is good to have an insight into real progress, courtesy of...

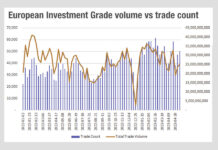

The implication of Europe’s falling volumes

An ominous sign in Europe’s secondary markets for dealers, as volumes remain in the doldrums.

Anecdotally, buy-side firms report volumes are up to 20%...

European credit – get it while it’s hot!

Bid ask spreads in European investment grade (IG) credit trading have fallen substantially over the past month, based on data from MarketAxess’s CP+ composite...