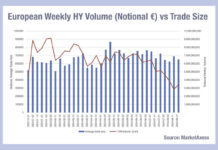

The effect of trade sizes on high yield liquidity costs

Trading in high yield markets across the Atlantic is diverging considerably, with average trade sizes and bid-ask spreads tracking quite different patterns, according to...

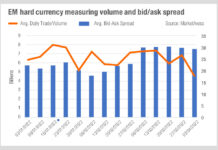

The cost of liquidity in EM today

A very graphic representation of the cost of liquidity can be seen in the latest data from MarketAxess. It shows that average daily volume...

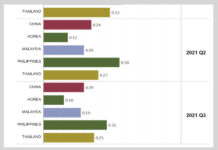

APAC trading recovery is far from even

The recovery from last year’s market sell-off and the ongoing Covid-19 pandemic appears to have been marked in many regions, with volumes for both...

Do Europe’s credit trading costs invert the pattern for US debt trades?

An analysis of average bid-ask spreads in corporate bond markets across the European and US markets suggests that median bid ask spreads responses are...

Secondary volumes in 2021 outpace 2020 sell-off implying greater liquidity

The first quarter of 2021 saw record volume in US and European investment grade trading volume. This is surprising on several fronts, with significant...

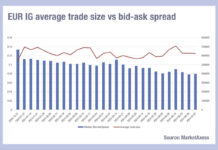

Europe IG credit trade size collapsed and has not recovered

Corporate bond traders has seen the average trade size reducing in Europe across both investment grade and high yield, suggesting that block trading is...

Europe’s incongruous drop in IG bid-ask spreads

European investment grade (IG) credit traders will have seen average bid-ask spreads declining since April, with the median average (typically about €0.03 cents lower...

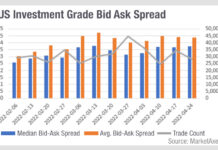

Is US investment grade market-making starting to fray?

In US credit, mean bid/ask spreads are skewing upwards from the median, indicating that a greater proportion of larger spreads are in some cases...

Excited or scared? The liquidity rollercoaster

Bid-ask spreads across all credit markets shot up in the week of 7 April, following the announcement of global tariffs on imports to the...

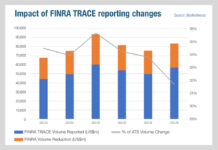

TRACE recalibration exposes double counting

An adjustment to bond trade reporting to TRACE, the US post-trade reporting tape for fixed income, has cut the volume of trades arranged via...