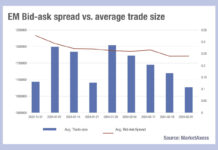

Emerging markets see liquidity costs decline

The cost of liquidity in emerging markets appears to be falling for fixed income traders. Looking at MarketAxess’s CP+ consolidated price feed, and cross-referencing...

Under pressure

Secondary markets trading has seen a net trend towards tighter bid-ask spreads for trading across all corporate bond segments in US, Europe and emerging...

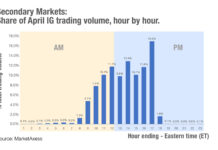

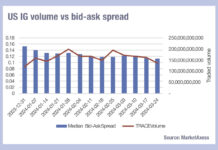

Chart of the week: When trading into the US, when should I trade?

Timing is everything in the markets, but not every market shares the same timing. It is common for trading desks to employ a trader...

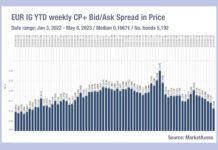

European credit – get it while it’s hot!

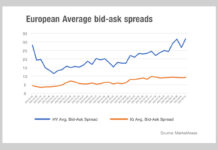

Bid ask spreads in European investment grade (IG) credit trading have fallen substantially over the past month, based on data from MarketAxess’s CP+ composite...

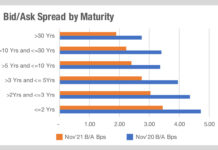

The impact of trading long-dated bonds

Faced with the prospect of climbing rates, some investors will be looking to switch out of lower coupon bonds to capture higher returns. However,...

What is driving down EM trading costs?

Analysis of trade size and bid-ask spread data from MarketAxess’s CP+ pricing feed and Trax market data, which tracks activity across markets, indicates that...

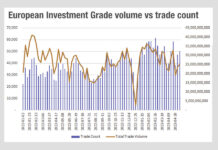

The implication of Europe’s falling volumes

An ominous sign in Europe’s secondary markets for dealers, as volumes remain in the doldrums.

Anecdotally, buy-side firms report volumes are up to 20%...

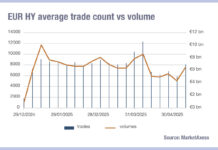

Is a liquidity crisis brewing in European HY?

Concern around liquidity in Europe’s high yield market has been rising over the past quarter as it is hit by a double whammy, falling...

Volumes drop off as Q1 ends, but liquidity still cheap

A broad decline of trading volumes across European & US corporate bond and emerging market debt trading coincided with end of the first quarter...

European liquidity costs remain high after April shock

Bond markets are beginning to settle on both sides of the Atlantic after the shock of Liberation Day and various amendments to tariff policies...