Forging new paths in fintech

MarketAxess’s head of business development for post-trade, Camille McKelvey discusses her personal journey, and the path to leadership for women in capital markets.

Camille McKelvey is...

A flying start to 2024 in European bonds may punish traders

The new year has seen a flying start in bond issuance in Europe, with a strong start relative to recent years driving €8.6 billion...

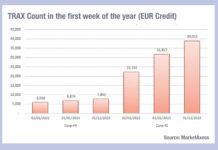

Does this year start with the smallest trades ever?

Trading activity in European bond markets at the start of 2024 has had the highest trade count of the past three years by some...

Betting the house

Mortgage origination in the US is predicted by the Mortgage Bankers Association (MBA) to rise significantly across 2024-25, yet trading of securitised mortgages still...

Review of 2023 Trading: Trade sizes falling – in parts…

Looking back at this year’s trading activity, through analysis of MarketAxess Trax data and TRACE for US markets, we can see clear patterns emerging...

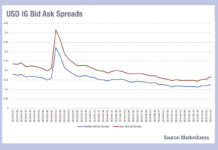

The beginning of the end (of liquidity provision)?

Bid ask spreads are widening in US investment grade credit, according to MarketAxess’s CP+ data, which may signal the traditional end-of-year withdrawal of dealer...

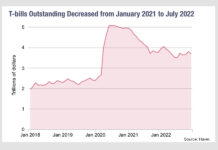

Treasury bill supply and ON RRP investment

By Gara Afonso, Marco Cipriani, Catherine Huang, Gabriele La Spada, and Sergio Olivas.

Take-up at the Federal Reserve’s Overnight Reverse Repo Facility (ON RRP) increased...

Pacific Western and Banc of California merge, sell US$1.9bn in bonds, munis and treasuries

Banc of California has today completed its merger with PacWest Bancorp, with both firms shedding billions of dollars’ worth of agency commercial mortgage-backed securities,...

Can you guess which market has seen the greatest fall in bid-ask spreads, year-to-date?

Two weeks ago, we asked what was crushing the US investment grade (IG) market’s bid-ask spread. However there has been an even greater reduction...

BIS: Cut your trading costs in half by cosying up to dealers

A new working paper, written by the Monetary and Economic Department of the Bank of International Settlements, has found that dealer relationships are crucial...