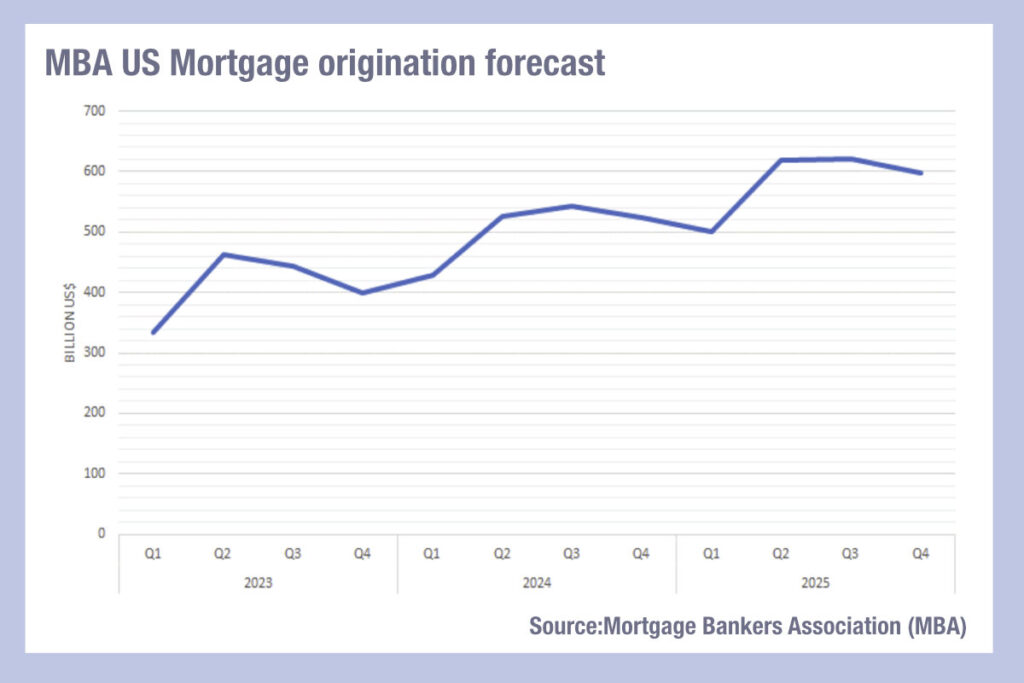

Mortgage origination in the US is predicted by the Mortgage Bankers Association (MBA) to rise significantly across 2024-25, yet trading of securitised mortgages still lags other fixed income markets, potentially creating impediments to risk transfer for investors and counterparties even as default risk rises.

Coalition Greenwich has made the case for increased electronification to reduce liquidity risk. Exposure to massively misjudged mortgage default risk triggered the sub-prime crisis in 2007 and while mortgage mis-selling is not an apparent risk in today’s climate, the sudden shift in interest rates creates a far more concentrated change in risk exposure in the future mortgage origination chain than existed over the previous decade.

Coalition Greenwich has made the case for increased electronification to reduce liquidity risk. Exposure to massively misjudged mortgage default risk triggered the sub-prime crisis in 2007 and while mortgage mis-selling is not an apparent risk in today’s climate, the sudden shift in interest rates creates a far more concentrated change in risk exposure in the future mortgage origination chain than existed over the previous decade.

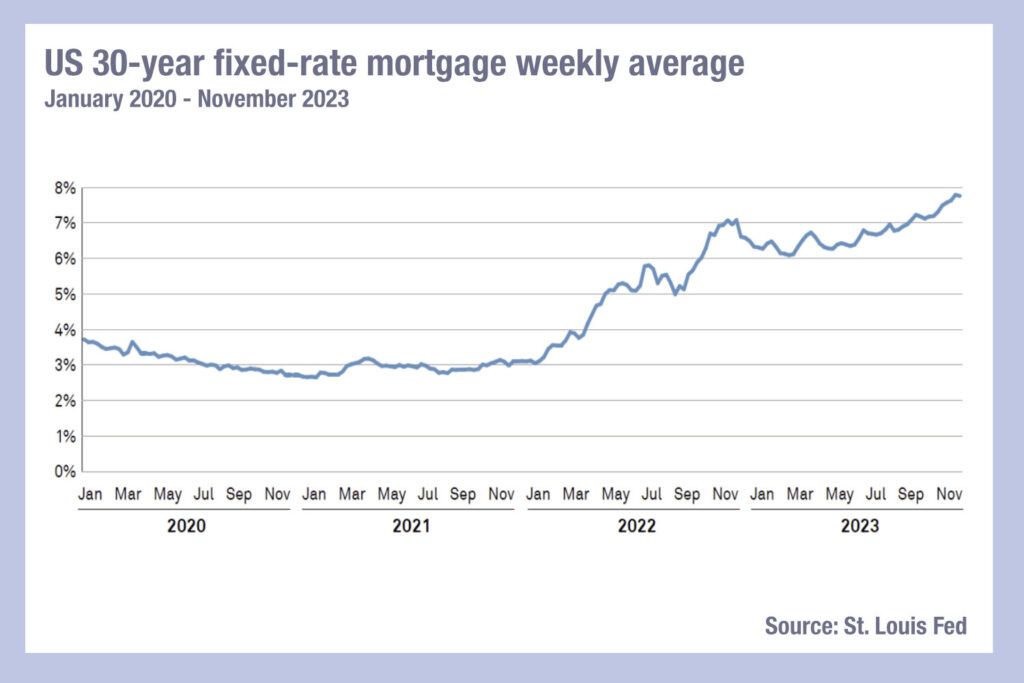

Data from the St Louis Federal Reserve show that the weekly average for 30 year fixed rate mortgages has climbed from 3% a the end of 2021 to nearly 8% in November 2023. With the MBA’s forecast of increased borrowing set to continue over the next two years, albeit expecting some decline in Fed rates, there will be an increased financial strain upon a larger set of borrowers. For investors in mortgage backed securities (MBSs), this would be a purely risk issue were it not for the illiquidity of the market. A to-be-announced trade (TBA) agrees to buying or selling an MBS on a specific date without detail on the exact MBS details. This inherently makes the assumption that MBS pools are relatively fungible and interchangeable, and increases market liquidity by focusing the trading of many contracts via pooled trades. However, research by Coalition Greenwich has found, “The effects of numerous changes to the current coupon, bank risk-management practices, and market uncertainty and volatility have resulted in challenged liquidity.”

Data from the St Louis Federal Reserve show that the weekly average for 30 year fixed rate mortgages has climbed from 3% a the end of 2021 to nearly 8% in November 2023. With the MBA’s forecast of increased borrowing set to continue over the next two years, albeit expecting some decline in Fed rates, there will be an increased financial strain upon a larger set of borrowers. For investors in mortgage backed securities (MBSs), this would be a purely risk issue were it not for the illiquidity of the market. A to-be-announced trade (TBA) agrees to buying or selling an MBS on a specific date without detail on the exact MBS details. This inherently makes the assumption that MBS pools are relatively fungible and interchangeable, and increases market liquidity by focusing the trading of many contracts via pooled trades. However, research by Coalition Greenwich has found, “The effects of numerous changes to the current coupon, bank risk-management practices, and market uncertainty and volatility have resulted in challenged liquidity.”

In a new report, Audrey Blater, a senior analyst on the Market Structure & Technology team, writes, “In normal market conditions, there are typically three actives in the 30-year TBA space predicated on a current or prevailing coupon. As a consequence of the spike in rates, several changes to the current coupon resulted in about eight to nine tradable coupons circulating in the TBA market that dealers must stand ready to price and risk-manage on behalf of their clients.”

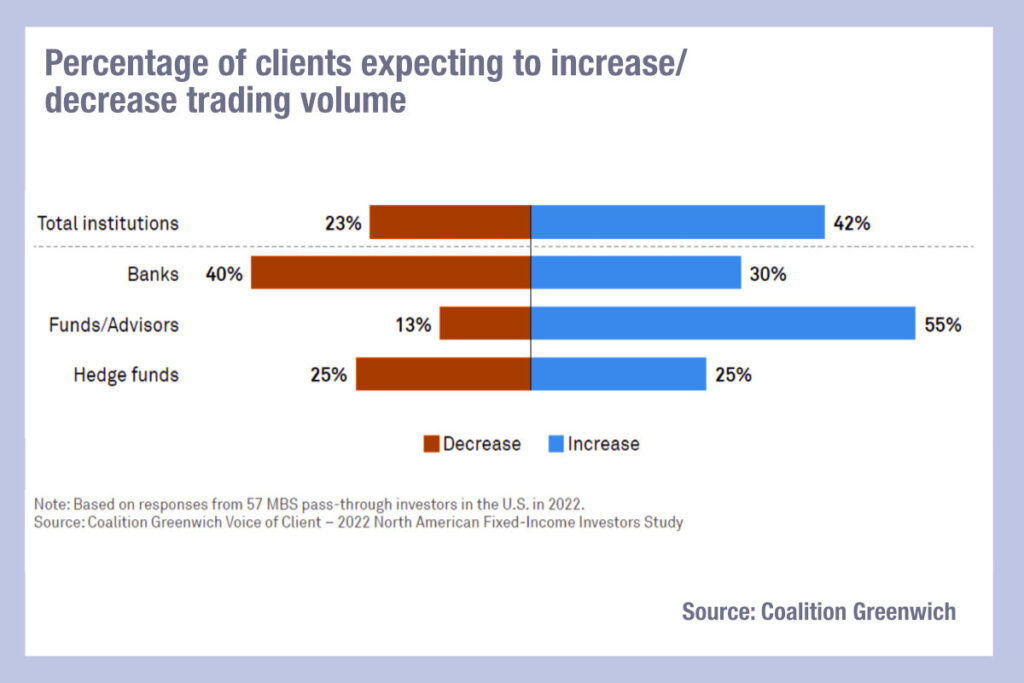

This expanded set of contracts reduces the liquidity-positive effect of netting contracts, she observed, and although 67% of buy-side investors indicated they will trade more volume in 2024, dealer engagement could reduce. “Despite struggles, market participants are still finding pricing and trading, as funds and advisors follow through on their commitment to the asset class,” she writes. “Although sell-side firms have been more reluctant to provide liquidity as a group, the path toward more electronification may be the answer to overcoming current conditions.”

This expanded set of contracts reduces the liquidity-positive effect of netting contracts, she observed, and although 67% of buy-side investors indicated they will trade more volume in 2024, dealer engagement could reduce. “Despite struggles, market participants are still finding pricing and trading, as funds and advisors follow through on their commitment to the asset class,” she writes. “Although sell-side firms have been more reluctant to provide liquidity as a group, the path toward more electronification may be the answer to overcoming current conditions.”

©Markets Media Europe 2023

©Markets Media Europe 2025