European Women in Finance 2022 – The Longlist

In 2020, Best Execution and The DESK hosted the first European Women in Finance Awards, following the model of Markets Media's long-established awards programme....

Project Amber: Dealer consortium developing new bond trading venue

A consortium of sell-side firms is developing a trading platform in the fixed income space, which could rival existing venues including Bloomberg, MarketAxess and...

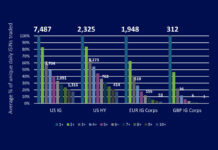

Are US dealers still offsetting credit trading risks?

As US banks see credit positions turn negative, and interdealer market volumes remain flat, The DESK asks how they offset risk as their credit...

Editorial: Asset managers wilt as banks impose hose-pipe ban

In the UK, during dry conditions, the government bans the public from using hosepipes in order to conserve water. In 2022, the sell side...

Headache or opportunity?

The UK is carving out its own path in financial services. Gill Wadsworth assesses the divergent gameplan the government is developing.

In May 2022, the...

Morningstar analysis shows fixed income funds under the cosh with thin liquidity

According to a new report from market data specialist, Morningstar, the unprecedented interest-rate hikes across developed markets has left most bond categories deep in...

Data: Are you part of the data disenfranchised?

Where some firms advocate ‘democratising’ data others struggle to capture, process or access data which is crucial to supporting the business.

Creating access to data,...

Trading: Regulatory overreach onto the trading desk

Complaints about regulators expanding rules for equity markets into fixed income are rising on both sides of the Atlantic.

The Securities and Exchange Commission (SEC)...

Research: Fixed Income TCA Survey 2022

Better integration into trading workflow

The DESK’s execution research survey into fixed income TCA 2022.

Our research took in 40 major asset management firms’ use...

Subscriber

On The DESK: What it takes to build a multi-asset trading team

Since becoming global head of trading at Schroders, Gregg Dalley has helped his teams become a single, multi-asset trading unit.

The DESK: What is your team’s...