Power to the people

New trading protocols can create paths to best execution or confound it through complexity. Chris Hall reports.

“Every nation gets the government it deserves” was...

CSDR mandatory buy-in delay welcomed

Umberto Menconi, head of Digital Markets Structures, Market Hub, Banca IMI, Intesa Sanpaolo Group

Since the financial crisis waves of new regulation and the need...

ICE freezes bond indices until 30th April

The Intercontinental Exchange’s (ICE’s) ICE Data Indices (IDI) has postponed the rebalancing of all the ICE and ICE BofA indices for bond, preferred and...

Greenwich Associates: Fixed income desks see highest buy-side tech spend

Technology spend on buy-side trading desks rose 4% in 2019 from the previous year, to reach US$2.2 million on average, with fixed-income trading desks...

Bond pricing battle shutters Nordic funds

Several Nordic fund managers have been shuttering fixed income funds, mainly in the corporate bond space, to allow them to get prices from banks...

Bond traders report screen prices are off by 10%

Several buy-side fixed income traders have confirmed that electronic prices are currently around 10% off the price that bonds are actually trading at, creating...

LSEG widens market maker spreads for government bonds, more ETFs

The London Stock Exchange Group has increased market-maker spreads to 5% for all exchange-traded products (ETPs), exchange-traded funds (ETFs) and UK government bonds -...

ICMA: Fully-automatic credit trading has grown; block liquidity has reduced

The International Capital Markets Association has found 44% of buy-side trading desks have increased their use of rules-based, fully automated electronic execution compared with...

Market data costs in spotlight under new FCA review

The UK’s Financial Conduct Authority (FCA) has issued a call for input (CFI) to better understand how data and advanced analytics are being accessed...

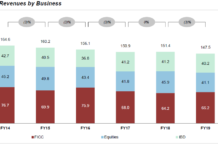

Fixed income up as investment bank revenues and headcount drop

Fixed income, currencies and commodities (FICC) revenues were up 3% year-on-year for investment banks in 2019, halting a two-year slide, according to the latest...