Tangible returns from bond trade automation

Adoption of automated trading continues apace across several bond markets and within different grades of instrument. Gareth Coltman, global head of automation at MarketAxess,...

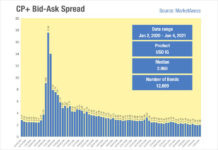

Sub-2bps bid-ask spreads in US IG are below pre-crisis levels

The US investment grade (IG) credit market is seeing very tight bid-ask spreads in 2021, according to the Composite Plus (CP+) data supplied by...

New EM issues make relationships matter

Buy-side emerging markets (EM) traders will be bonding well with their banks and brokers this year to make sure they are getting a slice...

Scotiabank, Rabo Securities and Huntington Capital Markets join DirectBooks

DirectBooks, the capital markets consortium founded to optimise the bond issuance process has signed up Scotiabank, Rabo Securities and Huntington Capital Markets to join...

Aegon AM wins short-dated investment grade bond mandates

Aegon Asset Management’s reports it has won two UK clients totalling £325 million for its short-dated investment grade bond strategy, with a further mandate...

Barclays now streaming prices into MarketAxess Live Markets

Barclays has committed to become a dedicated market maker and is actively contributing streaming prices for US investment grade corporate bonds to the MarketAxess...

Dealers grow FICC revenues 15% in first quarter of 2021

Sell-side fixed income, currency and commodities (FICC) revenues saw growth of 15% in the first quarter of 2021, according to new research by analyst...

How the ICMA got firm on bond pricing

Buy-side traders have long decried the lack of executable price in bond markets. For the best part of a decade the electrification of these...

Trumid collaborating with Jefferies in EM credit trading

Bond market operator, Trumid, is collaborating with Jefferies in emerging markets (EM) credit trading.

Jefferies will use Trumid’s Attributed Trading (AT) protocol and workflow solutions...

ESMA consultation on RTS 2 marks accelerated process

The European Securities and Markets Authority (ESMA) has launched a consultation on the development of draft regulatory technical standards to specify the pre-trade thresholds...