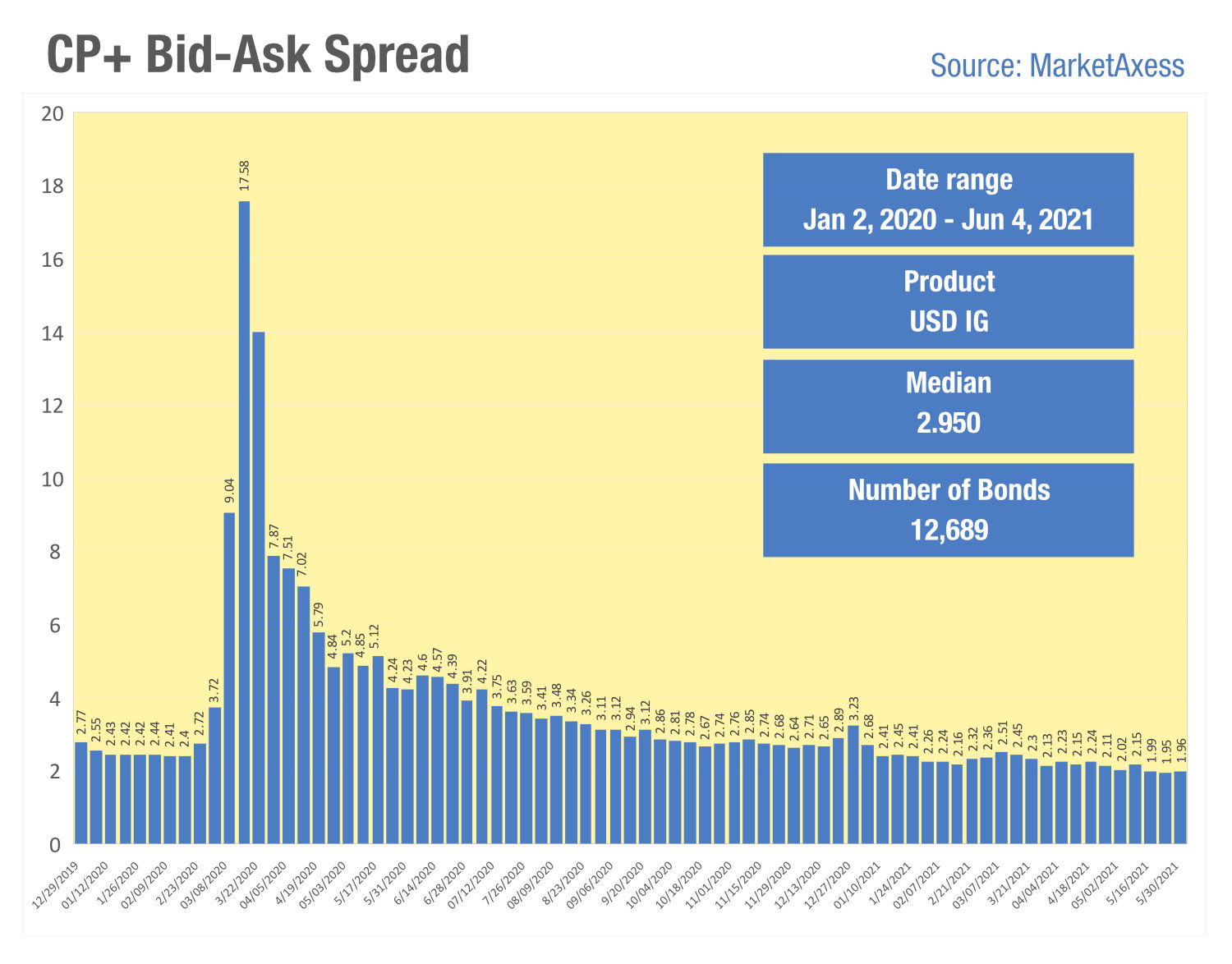

The US investment grade (IG) credit market is seeing very tight bid-ask spreads in 2021, according to the Composite Plus (CP+) data supplied by MarketAxess. It has found that the bid-offer has dropped below two basis points for the end of May, below even pre-crisis levels last year.

This is surprising but corelated with a drop in volumes, which have fallen year on year for the first time in a decade. If volume is dropping on both sides the overall depth of book is dropping. If spreads are also tight, it is fair to surmise that liquidity is worsening.

Credit has largely had a positive technical backdrop with overall inflows into IG staying healthy, drop off in supply from the primary market, but with foreign buyers keeping keen to get a slice of this US high grade credit. One trader noted that both liquidity and importantly a favorable hedge ratio were also playing a key part in that. In the absence of anything in the fundamentals to throw off the tight valuations being given it seems the markets will stay steady.

One possible cause of the lower volumes are the positive credit outlooks in IG twinned with effectively nothing new to move to, with most portfolio managers building their positions in Q1 thanks to the record volumes seen.

An absence of volatility will typically correlate with tighter spreads, and if trading has been in the more liquid end of IG – with activity leading to lower price impact than in less liquid instruments – and as another trader noted a possible uptick in portfolio trading, which allows bonds that might otherwise be illiquid to get priced and trade simultaneously, there could also have been a concentration of trading activity.

This could be a plus for firms trading electronically – low vol markets lend themselves to electronic execution – but traders would be wise to check their inputs into e-trading tools, as this market is looking thin and tight.

©Markets Media Europe 2021

TOP OF PAGE