Gilt activity spikes as new rates reality bites government borrowers

By Dan Barnes and Etienne Mercuriali

Gilts market opening on the morning of 9 January suggested some traders took a big hit, with stop losses...

TransFICC launches eTrading service for interest rate swaps

TransFICC, the specialist provider of low-latency connectivity and workflow services for fixed income and derivatives markets, has launched a new eTrading service, which combines...

EquiLend to launch Swaptimization platform in EU

Securities finance specialist, EquiLend, will be launching its Swaptimization platform in the autumn for financial institutions in the European Union.

The EU launch of Swaptimization,...

Pre-fight analysis: The weigh-in for CME vs FMX

The launch of FMX, the derivatives exchange chaired by Howard Lutnick, CEO of interdealer broker and services provider BGC Group, sets out a potentially...

People’s Bank of China sets out northbound rules for Swap Connect

The People's Bank of China has issued interim measures to standardise the interest rate swap market between the mainland and Hong Kong, protecting investor...

The interplay between the cash and derivative credit markets

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source...

Parameta and ICAP launch interest rate swap volatility indices

Parameta Solutions, in partnership with ICAP G10 Rates, has launched a family of interest rate swap volatility indices designed to enhance the investment decision...

MTS and Wematch.live launch digital marketplace for interest rate swaps

MTS, the European electronic fixed income platform owned by Euronext, and Wematch, the tech firm that provides buy- and sell-side firms' dealing workflow systems,...

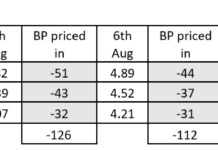

Tradeweb data reveals shock of rate cut expectations on swaps market

Analysis of Tradeweb data has show the level of surprise at potential central bank rate cuts over the past week in the interest rate...

Tradeweb announces JSCC clearing for MTF and SEF Yen swaps

Multi-asset market operator, Tradeweb has reported that institutional clients executing Japanese Yen swaps on its multilateral trading facilities (MTFs) and swap execution facilities (SEFs)...