The DESK’s Trading Intentions Survey 2020 : Tradeweb

TRADEWEB.

A real innovator in the trading protocol space, Tradeweb is constantly vying for the top spot with Bloomberg and MarketAxess.

Its pioneering of portfolio trading...

Subscriber

An EMS built for bond trading

Trading protocols in fixed income are multiplying and becoming more dynamic, placing demands on trading desks that only an EMS can manage.

An execution management...

The DESK’s Trading Intentions Survey 2020 : Streamed dealer prices

STREAMED DEALER PRICES.

Streaming prices from dealers provide a key perspective on the market, but unless they are executable they have limited value for trading....

Subscriber

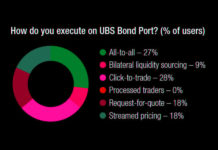

The DESK’s Trading Intentions Survey 2020 : UBS Bond Port

Adopting an agency approach has allowed UBS to deliver a service that has eluded many other banks via Bond Port.

As a result, the...

Subscriber

Power to the people

New trading protocols can create paths to best execution or confound it through complexity. Chris Hall reports.

“Every nation gets the government it deserves” was...

The DESK’s Trading Intentions Survey 2020 : Unpicking the buy-side workflow

We reveal the buy side’s use of platforms for pre-trade data, executing orders in the market and trading venues.

Trading Intentions Survey highlights

Bloomberg has...

Subscriber

Liontrust – The trading team built for growth

Matt McLoughlin, partner and head of trading at Liontrust Asset Management, explains why expanding trading capabilities to match AUM and asset class growth needs...

Tackling the cost challenge in fixed income trading

In today’s highly competitive and cost-conscious fixed income market, small and medium sized institutions can struggle without the efficiencies of scale which large institutions...

Repo market stress prompts calls for central bank support

Could central bank intervention bypass sell-side intermediaries, if they only act as agents not risk takers? David Wigan reports.

The stresses in the US repo...

CSDR mandatory buy-in delay welcomed

Umberto Menconi, head of Digital Markets Structures, Market Hub, Banca IMI, Intesa Sanpaolo Group

Since the financial crisis waves of new regulation and the need...