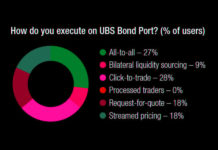

The DESK’s Trading Intentions Survey 2020 : UBS Bond Port

Adopting an agency approach has allowed UBS to deliver a service that has eluded many other banks via Bond Port.

As a result, the...

Subscriber

Pre-trade data: The next generation

The first generation of pre-trade analytics are consolidating; the second generation of price and liquidity providers such as Bondcliq and Katana will need to...

Europe’s liquidity rules are holding up… for now

New guidance on fund liquidity has followed redemption concerns in European equity and bond funds, writes Lynn Strongin-Dodds.

The risk that funds are unable to...

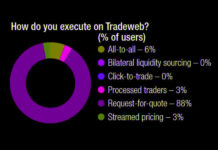

The DESK’s Trading Intentions Survey 2020 : Tradeweb

TRADEWEB.

A real innovator in the trading protocol space, Tradeweb is constantly vying for the top spot with Bloomberg and MarketAxess.

Its pioneering of portfolio trading...

Subscriber

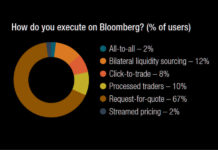

The DESK’s Trading Intentions Survey 2020 : Bloomberg

Bloomberg has a strong position as data provider, interface into the market and a trading venue.

The ubiquitous terminal allows it to build new services...

Subscriber

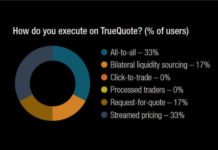

The DESK’s Trading Intentions Survey 2020 : TrueQuote

TRUEQUOTE.

A new entrant in the market in 2019, TrueQuote has seen remarkable success, rapidly building market share and moving quickly to develop trading protocols...

Subscriber

Tackling the cost challenge in fixed income trading

In today’s highly competitive and cost-conscious fixed income market, small and medium sized institutions can struggle without the efficiencies of scale which large institutions...

Power to the people

New trading protocols can create paths to best execution or confound it through complexity. Chris Hall reports.

“Every nation gets the government it deserves” was...

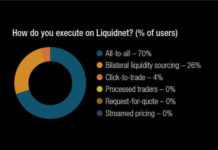

The DESK’s Trading Intentions Survey 2020 : Liquidnet

LIQUIDNET.

Liquidnet’s strength as a block-trading platform in the equity market may have paved its way for buy-side adoption in bonds, but it has certainly...

Subscriber

An EMS built for bond trading

Trading protocols in fixed income are multiplying and becoming more dynamic, placing demands on trading desks that only an EMS can manage.

An execution management...