The DESK’s Trading Intentions Survey 2021 : Neptune

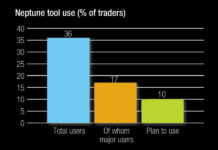

Neptune has expanded its user base to 36% of buy-side traders in 2021 up from 29% in 2020, a considerable increase and one that...

Subscriber

The DESK’s Trading Intentions Survey 2021 : Profiles

Bloomberg

Bloomberg has the highest penetration of any provider into the buy-side fixed income trading desk. This year has seen it significantly revise charges to...

Subscriber

The DESK’s Trading Intentions Survey 2021 : MarketAxess

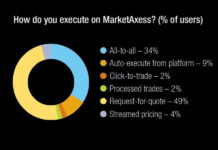

Consistently rated as the most effective platform for finding liquidity in the corporate bond market, MarketAxess has frequently been ahead of the market in...

Subscriber

Research: How mid-sized asset managers e-trade larger orders

The DESK’s research supported by LTX, finds liquidity improving, larger electronic trade sizes and greater use of data science pre-trade.

In 2024 bond markets are...

Subscriber

The Tenth Annual Trading Intentions Survey

Key parts of bond market electronification are still up for contention, with stiff competition across pre-trade, primary and secondary market services.

In 2024 The DESK...

Subscriber

Pre-trade data demand grows and platform concentration weakens

The 5th Annual Trading Intentions Survey sees a hunger for data and a surge in new liquidity tools.

Key takeaways:

• Massive growth for crossing / mid-point...

Subscriber

Mutual funds leveraging futures to increase portfolio risk and yield

US Treasury futures holdings among mutual funds have shot up over the last three years, as they adjust to a “higher for longer” interest...

Subscriber

Trading Intentions Survey 2018

Greater dependence vs reduced choice

The pipeline of growth is returning after MiFID II, with reliance on specific platforms increasing.

In 2017 the appetite for onboarding...

Subscriber

Research: Competition proves tough for O/EMS providers

Onboarding time shows the challenge facing EMS & OMS firms but algo trading increases demand

Two years ago Flextrade had a big pipeline of new...

Subscriber

August: US Treasuries record first trillion-dollar ADNV

US Treasuries had their first trillion-dollar month in August thanks to a surprise rate hike from the Bank of Japan and ongoing fiscal uncertainty...

Subscriber