Nasdaq reports seven-year error in closing auction

Story updated 16.00 BST 30/8/18

In a Trader Alert published at 08.30 ET, on 30 August 2018, updating a previous notice published on Friday 24...

NEX Markets CEO questions Thomson Reuters price claim

By Pia Hecher.

Seth Johnson, chief executive officer of NEX Markets, operator of US Treasury marketplace BrokerTec, talks about the firm’s data distribution strategy, including...

Bank of England: Basel III regulation hurts repo for smaller asset managers

By Shobha Prabhu Naik.

A working paper written by Antonis Kotidis and Neeltje van Horen, staff for the Bank of England, has identified that the...

List trading goes live on MTS BondsPro all-to-all order book

MTS Markets , part of London Stock Exchange Group (LSEG), has added list trading functionality to its MTS BondsPro corporate bond trading platform, enabling...

Brokertec data shifts to Bloomberg with Reuters/Dealerweb data tie-up

By Shobha Prabhu Naik & Dan Barnes.

Bloomberg, the financial data provider, has launched a new data service that will take NEX’s BrokerTec US Treasuries...

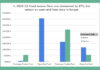

MarketAxess volumes up 16.4%; EM and all-to-all lead growth

By Pia Hecher.

Venue operator and data provider MarketAxess has announced its second quarter results with significant upward trends in overall trading volume, including Open...

Algomi/Euroclear deal may open access to 373,000 bonds

Pre-trade data provider Algomi has significantly extended the universe of bonds for which it can publish trading opportunities, by signing a new agreement with...

BGC buys embonds, lay-offs confirmed

Interdealer broker BGC has confirmed its May 2018 acquisition of emerging markets bond trading platform embonds, while several sources close to the firm have...

Federal Reserve group issues credit risk warning over US Treasuries trading

By Pia Hecher.

The Federal Reserve’s Treasury Market Practices Group (TMPG), which discusses issues in the US government bond market, has said that firms are...

IHS Markit claims Liquidnet clients see transaction cost savings of 87%

By Shobha Prabhu-Naik.

Information provider IHS Markit claims that buy-side firms trading all-to-all receive 87% transaction cost savings, by trading on Liquidnet Fixed Income.

IHS Markit...