E-trading boosts efficiency not liquidity in Japan’s buy-and-hold bond market

Japan’s bond market has long been seen as voice-heavy, with established traditions of relationship-based trading and an aversion to electronic, less personal alternatives. However,...

On The DESK: Leaders in bond trading pinpoint risks and opportunities

We asked the buy-side traders we have profiled on The DESK for the past ten years to discuss the biggest changes they thought had...

The interplay between the cash and derivative credit markets

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source...

Opinion: Competition, not regulation, will make better bond markets

European credit trading has historically seen levels of electronic trading of around 50% of total corporate credit trading, while the US market has historically...

CME’s US corporate bond index futures to launch 17 June

CME Group has revealed that its new credit futures are scheduled to begin trading on 17 June 2024, pending regulatory review.

Launching alongside the company's...

Top tips from TradeTech: Connect debt, derivatives and equity trading

Buy-side traders have observed that close ties in the trading team based on the targets on an investment – be that corporate or government...

The credit trading processes you really should have automated by now…

Automation has historically been highly challenging in corporate bond markets for several reasons, but traders say some parts of the workflow ‘ought’ to be...

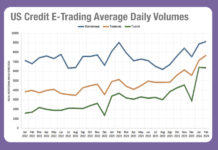

Exclusive: Analysing the battle for US e-Trading in February

The highly competitive corporate bond market saw average daily volumes converge in the US across electronic trading venues in February. The DESK has exclusively...

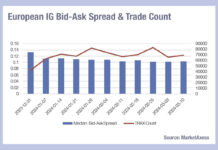

European investment grade seeing smaller, cheaper trades

European investment grade bond traders are seeing a falling bid-ask spread, and a rising trade count since the start of 2024, according to MarketAxess’s...

Swedish broker shut for pushing risky bonds and illicit issuer payments

Swedish market regulator, Finansinspektionen (FI), has revoked all permits for Nord Fondkommission AB (Nord FK) to continue trading.

Nord FK is a securities firm whose...