November gives Tradeweb its second highest month’s ADV ever

Market operator Tradeweb has reported today total trading volume for November of US$18.7 trillion across its electronic marketplaces for rates, credit, equities and money...

Analysis: Electronic trading across US and European bond markets

Electronic trading of US credit erupted in May 2024, according to analysis of the US credit market by Coalition Greenwich. It found that investment...

Subscriber

Moody’s: Speculative-grade credit default rate to rise in 2023

Moody’s Investor Services expects the global speculative-grade corporate default rate to rise in 2023 as slowing economic growth, higher input costs and rising interest...

On The DESK: Leaders in bond trading pinpoint risks and opportunities

We asked the buy-side traders we have profiled on The DESK for the past ten years to discuss the biggest changes they thought had...

Exclusive: MarketAxess trials new mid-point session protocol Mid-X

On Tuesday, MarketAxess ran the first session of a new mid-point matching tool, Mid-X, with over 50 participants. The new trading protocol is session-based...

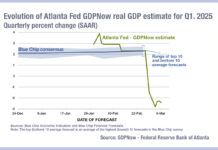

Implications of Atlanta Fed negative GDPNow score for US credit

The Atlanta Federal Reserve’s GDPNow estimate for real GDP growth in the US hit 2.4% on 6 March 2025, up from -2.8 percent on 3 March,...

Eurex launches the first futures on a Euro High Yield Index

From 17 October 2022, Eurex will offer market participants the opportunity to hedge the Euro-denominated high-yield corporate bond market in Europe.

This segment has been...

Are US dealers still offsetting credit trading risks?

As US banks see credit positions turn negative, and interdealer market volumes remain flat, The DESK asks how they offset risk as their credit...

Jefferies moves into outsourced fixed income trading with Siegel hire

Industry veteran Jory Siegel has joined Jefferies as head of fixed income outsourced trading, from Marex.

Siegel was previously managing director and head of fixed...

Harrington joins Columbia Threadneedle

Marc Harrington has been appointed as senior fixed income trader at Columbia Threadneedle Investments. Harrington’s carrier as a buy-side bond trader, last saw him...