Exclusive: Cboe goes live with US Treasury trading

Cboe has gone live with cash Treasury trading, the first trade having been conducted in mid-October. It is operating a ‘Full Amount’ execution protocol...

Can you guess which market has seen the greatest fall in bid-ask spreads, year-to-date?

Two weeks ago, we asked what was crushing the US investment grade (IG) market’s bid-ask spread. However there has been an even greater reduction...

BIS: Cut your trading costs in half by cosying up to dealers

A new working paper, written by the Monetary and Economic Department of the Bank of International Settlements, has found that dealer relationships are crucial...

Fusan Exchange issues tokenised sukuk backed by sovereign-linked instrument

Fusang Exchange, a digital stock exchange operator regulated and supervised by the Labuan Financial Services Authority in Malaysia, has tokenised and listed a digital...

BlackRock veteran Mitchelson to join Bloomberg

Multiple sources have confirmed that Rob Mitchelson, formerly Europe, Middle East, Africa (EMEA) head of fixed income and FX trading at BlackRock, is to...

Danmarks Nationalbank now centrally clears repos at Eurex

Danmarks Nationalbank is now actively trading and centrally clearing repo transactions at derivatives market operator Eurex, which cites the onboarding of the first Nordic...

US Treasuries: Coalition Greenwich update on falling interdealer volume and BIS warning

US markets have had an eventful summer according to analysis by Coalition Greenwich, which saw an average daily notional volume (ADNV) for US Treasuries...

Tradeweb announces JSCC clearing for MTF and SEF Yen swaps

Multi-asset market operator, Tradeweb has reported that institutional clients executing Japanese Yen swaps on its multilateral trading facilities (MTFs) and swap execution facilities (SEFs)...

What’s all the fuss about… the US Treasury market?

Who is kicking up a fuss about US government bonds?

A new paper published by Darrell Duffie for the Jackson Hole Symposium entitled ‘Resilience redux...

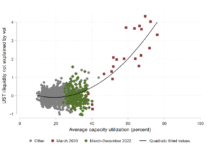

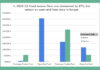

Analysis: Market response to US Treasury’s increased borrowing needs

The US Treasury’s need to increase debt issuance, beyond market expectations, has had several effects. Firstly there was a ratings downgrade of the USA...