Implication of US bank downgrades on credit markets

Markets are truly feeling the economic pressures at present, with Moody’s downgrade to US financials on Monday following Fitch’s controversial downgrade of the US,...

LatAm sees e-trading momentum with support for all-to-all

In Latin America, 46% of trading in corporate hard currency bonds is conducted electronically, according to research by analyst firm Coalition Greenwich, compared to...

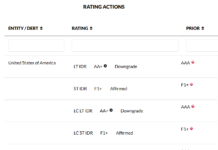

The US: Too big to Fitch?

Ratings agency Fitch has downgraded the United States’ long-term credit ratings to AA+ from AAA and removed the rating ‘Watch Negative’ stating “ reflects...

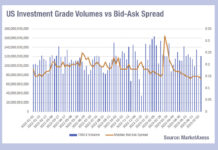

Implied cost of liquidity falling, with US high yield an exception

Volumes in the corporate bond markets have been picking back up, relative to bid-ask spreads, indicating an improving liquidity picture across the US and...

Trumid adds RFQ to credit trading protocols

Electronic bond market operator Trumid, has launched new Request for Quote (RFQ) trading on its platform. Trumid clients can now initiate, view, and respond...

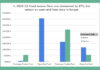

Review: Mixed bond trading revenues in choppy first quarter

Banks have seen mixed results from bond trading in the first quarter of 2023, across credit and rates, while electronic trading platforms have seen...

Candriam promotes bond chief to CIO

Candriam, the global multi-asset manager has appointed Nicolas Forest, Candriam’s global head of fixed income since 2013, as its new chief investment officer (CIO),...

Electronic credit platforms report fresh rises in trading volumes for March and Q1

Electronic bond market operators saw a new boost to volumes in March, and in the first quarter more broadly, as volatility in capital markets...

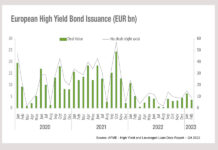

Rising rates hit high yield availability

Despite some optimistic outlooks on bond issuance in 2023, high yield bonds are clearly seeing a decline in Europe, based on data from the...

Did UBS/CS deal terms just revalue the entire AT1 bond market?

Buy-side trading desks say they are looking at the risk of contagion across financials, following the takeover of troubled Credit Suisse by UBS, for...