Artificial intelligence (AI) will be a major topic of conversation at the Fixed Income Leaders’ Summit (FILS) in Nashville this year, with its potential to support data aggregation and unstructured information offering real facility for scaling up trading capabilities.

Neal Rayner, head of US fixed income trading at Janus Henderson, said, “FILS is always a very informative event and will be just as impactful this year with elevated rates, inflation, and recession risks. Learning how colleagues are navigating the fixed income markets will be of particular interest as well as the usual conversations around data aggregation, pre- and post-trade analytics and, the topic of the year, AI and how this new and potentially powerful technology is evolving.”

Efficiency will be important both as a way to drive more alpha-generative opportunities, but also to scale up capabilities as buy-side desks see activity levels outpacing the desk-level resources, which we have seen being either maintained with hiring freezes or even falling.

With both Bloomberg and JP Morgan reported to be developing chat functions that could bolster trading, understanding practical ways to use these new abilities quickly and efficiently to fill in operational gaps today prove rewarding.

Dwayne Middleton, global head of fixed income trading at T Rowe Price, says, “We have been discussing integration of the order and execution management systems (OMS/EMSs) and interoperability was a topic last year. Is AI the catalyst to gaining traction on those two initiatives? Can AI be used in a practical way to reduce clicks, [to support] application context switching to automate manual workflows and push data on-demand?”

A big item on the agenda is the macro picture, with political and central bank decisions still driving a lot of market activity, and therefore impacting investment and trading decisions. Clearly the shift from quantitative easing to quantitative tightening has an effect on liquidity levels, but a very uncertain outlook is also paralysing some parts of the market, with many investors uncertain which way to jump.

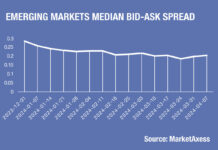

Volatility is also making it more challenging for dealers to price when making markets, and as a result their support for liquidity is reduced, having not been great at many times already. Collectively, volatility and uncertainty are making it difficult to trade at some points in the market.

Over the past five years The DESK’s research has found a greater adoption and use of pre-trade analytics, and more broadly a greater consumption of higher quality data, on the buy-side bond trading desk in order to optimise execution in the credit space.

There have also been changes in the way that trading occurs over the same period. Traders report a ‘barbelling’ of activity, with medium sized trade numbers reducing, and an increase in larger trades, dominated by the bank market makers, and smaller trades, notably those sub-US$1 million, being picked up efficiently by ETF market makers.

Where liquidity patterns have changed, analytics become invaluable as a way to identify the best paths to execute trades.

“I expect a lot of focus on the evolution of electronic trading technology and protocols, and how the landscape of electronic trading is changing as a result,” says Susan Joyce, VP and trader at AllianceBernstein. “I think there is strong recognition of the power of execution execution management system (EMS) technology, as well as the need for trading desks to have a clear electronic strategy in order to capture that power. I’m also anticipating robust discussions on upcoming regulatory pressures facing fixed income markets.”

However, these tools can only find liquidity where it exists. Investment banks have struggled to deliver strong returns in secondary market trading and there is a risk that dealers as a whole may reduce the resources they put into client liquidity provision.

There are questions around the effectiveness of certain technology investments and there will be a chance to compare notes on the better – and worse – acquisitions that buy-side desks have made to date.

Lindsey Spink, head of global fixed income trading at American Century Investments, says, “I’m very interested in [whether there is] buyers’ remorse on too many systems? How are firms handling tech budget belt tightening?”

He also observes that the response to trading in a more automated way – which varies considerably from firm to firm – is also big question which peers will want to compare notes on.

“Where are traditional firms in the low vs high touch desk structure?” he asks.

AI, better data and analytics, along with enhanced system integration, can all play a role in making that structure more effective but it will be interesting to see how the potential has met reality on the conference floor.

©Markets Media Europe 2023