Work smarter with MTS Auto Execution – trade automation at your fingertips

Paul O’Brien, Senior Product Manager at MTS Markets

Automation has become so imbedded in our everyday lives that most of the time we don’t even notice. From online shopping or renewing an insurance policy to the sat nav systems in our cars, automation blends seamlessly into our day-to-day existence. Its evolution has brought with it great efficiencies and savings, allowing us to spend more time on the things that bring real value to our lives.

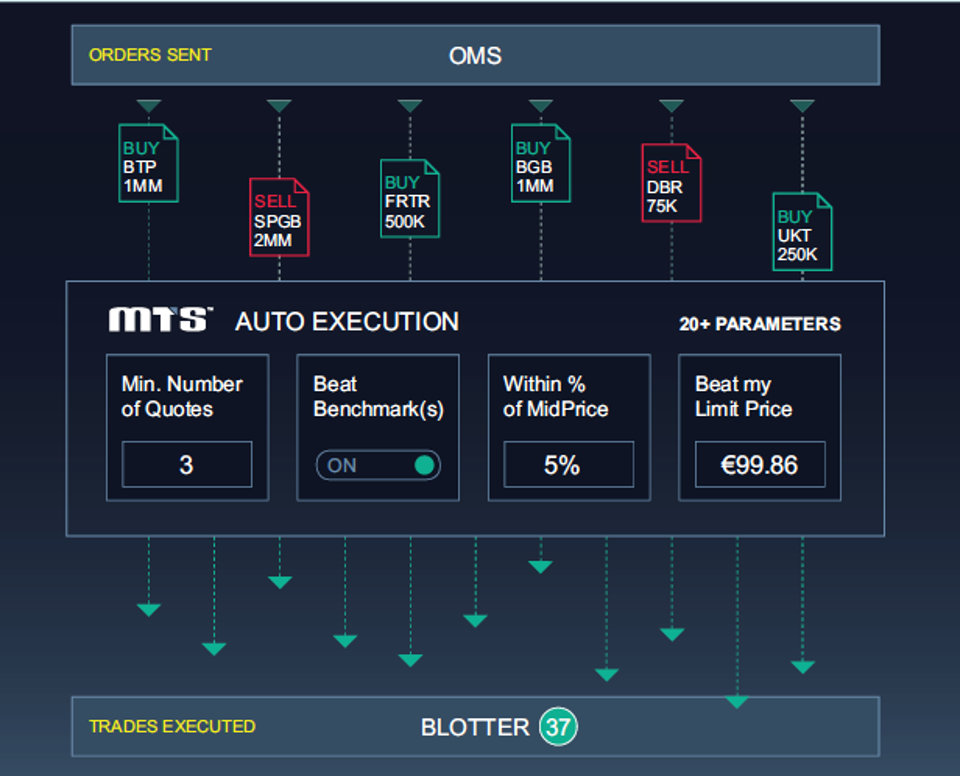

Not for the first time, the bond market has been slow to evolve. It’s only relatively recently that buy-side traders have started to embrace the benefits of automation and in response we’ve developed a tool that allows clients to automate their trade execution just as easily as they might automate their weekly shop. MTS Auto Execution, part of the newly re-designed BondVision platform, allows clients to configure 20+ parameters in real-time, to fully automate all aspects of the trade execution workflow from bond eligibility and dealer selection through to the ultimate execution of an order at the best available price.

Express checkout

MTS Auto Execution is the modern trader’s equivalent of automating your weekly supermarket shop with time and efficiency savings, similar to 1-click ordering, price matching and same day delivery. No more driving to the high street, trawling the aisles for the best-priced goods and queuing at checkout – shopping online removes the stress while saving time and money.

Just as you might schedule repeat deliveries of day-to-day household items, so too might you automate your low touch bond execution. No more time spent manually sending individual ‘request for quotes’ for small orders in liquid bonds where you have no competitive advantage; saving you time to spend on more profitable trades. When clients stage orders from their OMS to MTS BondVision, all eligible items will be recognised by the relevant Auto Execution rules that have been created and traded automatically if the necessary criteria are satisfied. Take the express checkout lane with your trading and execute hundreds of orders within a matter of seconds.

Price promise

Auto Execution provides best execution for your bond trading just as a price comparison website does for your insurance renewal. Users can systematically select the most appropriate dealers for a trade based on, among other things, axes, indicative pricing and trading history and can ensure best execution is achieved by tracking price movements in a specified benchmark such as the MTS Composite. MTS Auto Execution allows clients to leverage the latest technology and trade with confidence at the very best price available.

One-click ordering

Online shopping has evolved to the point where placing an order can be done with a single click; similarly, we’ve put an intuitive, easy to use interface at clients’ fingertips. Users can quickly and easily create their automation rules, and make real-time changes to their configuration, as market conditions fluctuate. The focus on creating an intuitive, frictionless user experience is done with the goal of making automation accessible to clients of all levels of sophistication, even those who have never previously embraced automation.

The introduction of real-time Auto Execution alerts goes hand in hand with the focus placed on delivering a great user experience. These alerts notify users when orders fail to automatically execute along with details of the reason for the failure. For instance, if an insufficient number of quotes are in competition at the time of execution then the order will be cancelled, and the user will be notified accordingly. The user then has the option to trade that bond manually using a traditional RFQ or tweak their parameters in real-time and re-run the Auto Execution logic.

The next generation of Auto Execution

Since the launch of MTS Auto Execution in October, we’ve had great client interest from the asset management community. Clients value the ease of use of the system along with the ability to easily tailor their automation strategies in real-time from our revamped buy-side trading platform; offering flexibility and putting the power in their hands has really struck a chord with traders. When it comes to the automation of trade execution, having full visibility and total control over your rules will be key going forward as the level of sophistication and the granularity of the rules created increases.

The ability to leverage on our existing OMS connectivity network and the technical architecture of our RFQ protocol allows us to enable clients for Auto Execution within a matter of minutes, without any development work or financial investment needed on the side of the client. As always, we work closely with our client base during the development and roll out of new functionality and this has been particularly true for the Auto Execution tool. Sitting with clients to explain how the various parameters behave and discussing how best to configure the system to achieve their trading objectives is part and parcel of the on-boarding process, especially for clients looking at automated trading for the first time. Furthermore, users can trial their automation rules in our test environment ensuring they are totally comfortable with their setup before taking it into production.

Don’t work harder, work smarter

You probably won’t buy your next house online; similarly, you probably won’t execute all your orders automatically. Our Auto Execution system allows you to create different rules for orders of different sizes and different levels of risk – you retain total control over what is done automatically and what is done manually. A kill-switch is also available, so clients can quickly turn on and off the Auto Execution system with a single click allowing traders to take over and execute their order manually during times of volatility.

The real value to be realised from the automation of bond trading is that it frees up traders to dedicate more time to their more profitable trading opportunities. Save yourself the stress of that next trip to the metaphorical bond supermarket; don’t work harder, work smarter with MTS Auto Execution.

www.mtsmarkets.com