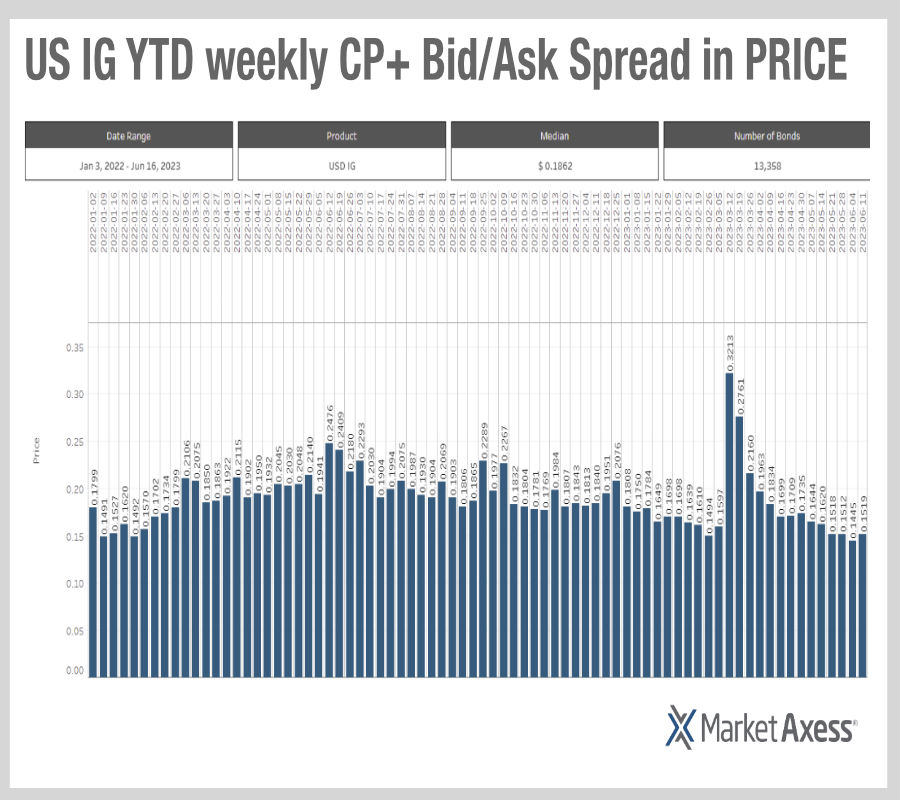

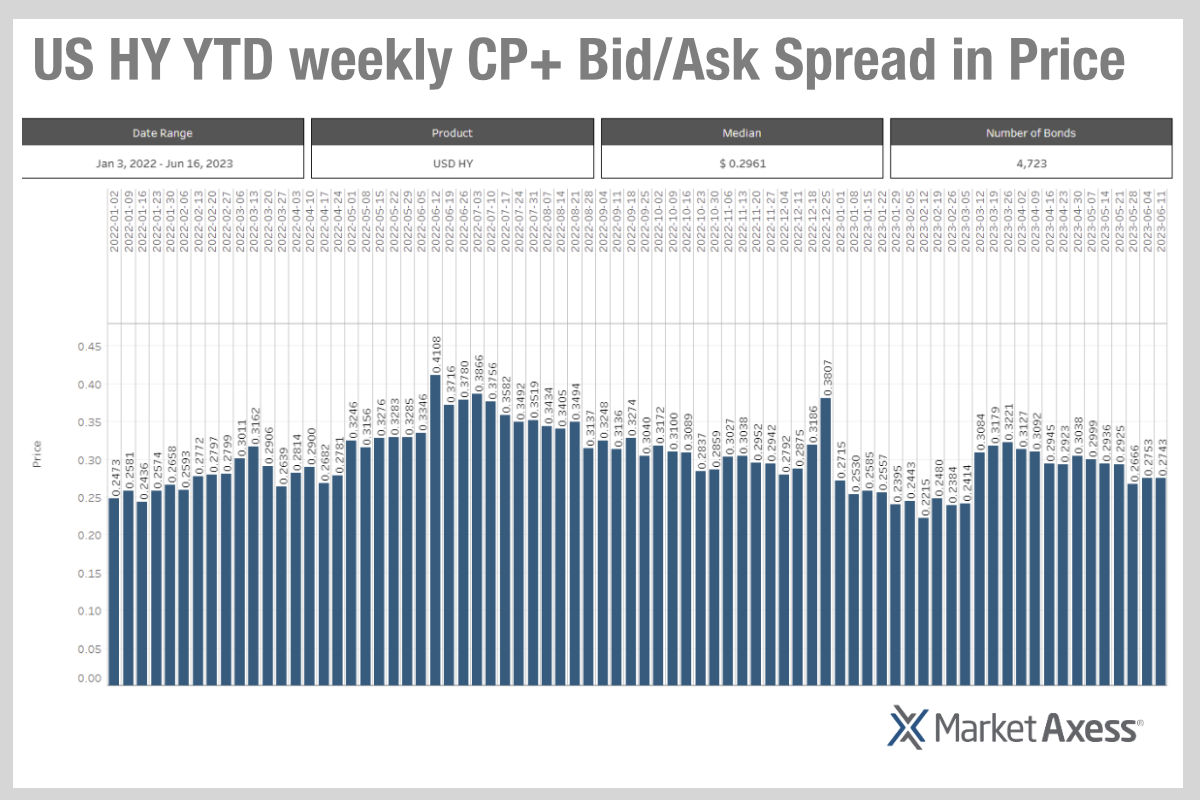

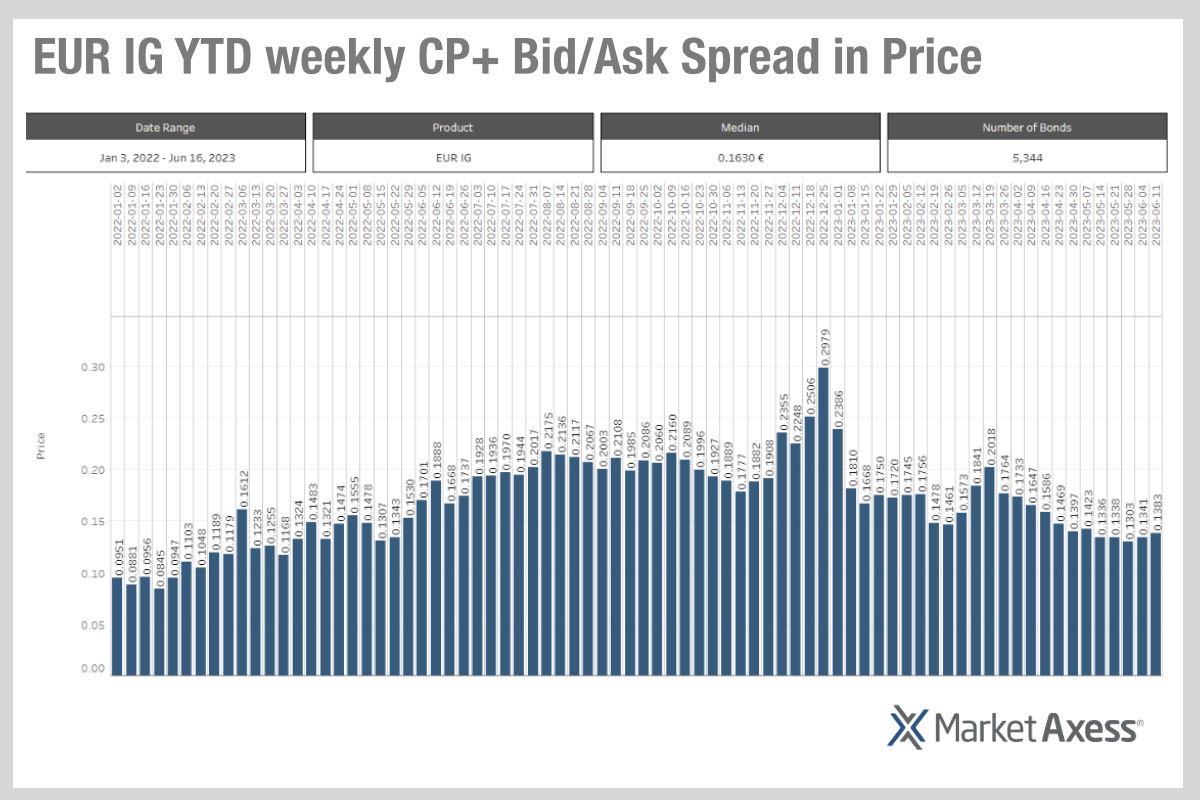

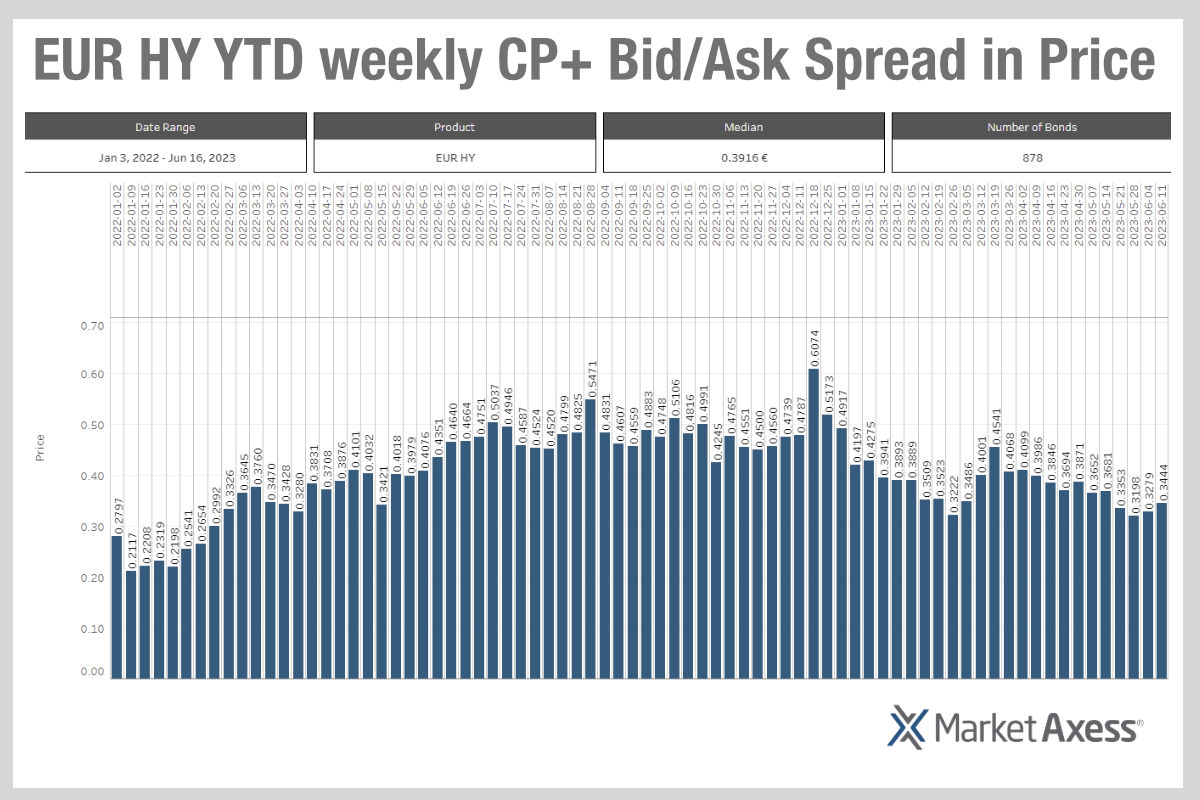

Summer is seeing the cost of trading in fixed income markets begin to tick up again, as bid ask spreads begin to widen, according to CP+ bid-ask spread data from MarketAxess.

Although trading costs in the US and Europe have receded from their spike in March 2023, an increase would not be too surprising ahead of a challenging set of half year results for banks, who have largely seen their profitability fall, making the capacity to trade and hold inventory challenging.

A new paper by Morgan Stanley, focused on the municipal bond markets, has found that “outsize, stale positions drive wider spreads. Stale street longs can impact your portfolio, even if you’re not actively trading. For example, not only are airports and hospitals ineligible for ETFs; spreads in each widened when dealer positions grew too heavy. New York tells a similar story: spreads widen when dealer stocks get too heavy.” The logic behind this is not complex; dealers have a finite ability to warehouse risk. The extent to which they can manage client demand in secondary markets.

The point this paper also makes is that when supply is down and in munis that is the case by 20% YoY, primary dealer balances are unchanged, but implies that secondary inventories are taking up a greater share of dealer balance sheets than they previously were. “As long as supply remains light, the calendar won’t be a good proxy for the mix of street offerings,” note the paper’s authors. In credit, issuance has also been lower as rates have risen, and although it has been expected to pick up as the year goes on, we may see that the sell side are facing dual pressures, impeding their market making activities.

Firstly, we are seeing job cuts and pressure on lowering costs. Secondly, with falling returns for many banks there is the possibility of a retreat from market making by some sell-side firms.

Going against that, over the longer term, we know that several banks have been making big-name hires in order to attract clients and trading volume along with them. This demonstrates that appetite exists to own the market making environment.

However, there is good reason to expect some variability in dealer activity if the current trend of widening bid-ask spreads continues. Pinpointing where liquidity can be found pre-trade, whether that be direct through high quality data sources, or based on TCA-style analytics to assess recent broker performance could be very useful in the next few months. The DESK

©Markets Media Europe 2023