Update: How big is portfolio trading?

In November 2020, we assessed the prevailing research on the size of portfolio trading in the corporate bond market. A new report from Coalition...

Ediphy Markets launches Ediphy Credit

Ediphy Markets has launched Ediphy Credit, a service to help institutional asset managers access better liquidity in corporate bonds. Ediphy Credit combines data analytics...

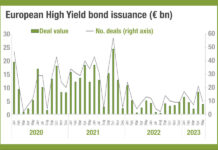

High yield issuance may bounce back

The data for Q1 bond issuance in European high yield (HY) markets shows that it fell 22.7% according to the Association for Financial Markets...

Cboe Credit Index Futures: The expanding liquidity picture

As buy-side firms look to increase their exposure to credit futures, market operators find ways to support access.

The DESK spoke with David Litchfield, director...

Strong bond issuance raises Q1 bank revenues, Citi up 62%

Goldman Sachs broke the mould for fixed income market makers in Q1, achieving a 6% year-on-year revenue growth, reaching US$3.47 billion.

However, despite declines in...

Credit Market Structure Alliance conference fights to bypass commercial debate

Now in its second year, the CMSA conference fights for the right to maintain integrity on stage.

ViableMkts is hosting the next installment of the...

Fixed income is Nasdaq’s greatest challenge

By Flora McFarlane.

Market operator Nasdaq has reported second quarter revenues from fixed income, commodities and currency (FICC) remained at US$19 million from Q1 2017,...

End to End CSDR Processing – Roles, Responsibilities, and Issues for all Participants

On 22nd July, 2020 a panel of market participants discussed the detailed implications of the Central Securities Depository Regulation (CSDR).

The panel comprised, J.R. Bogan,...

FILS 2021: The five big questions at FILS this year

1. When will we see a functional consolidated tape?

Market structural discussions at FILS will naturally take in European Commission’s plans for the proposed consolidated...

Buy side reports price movement risk in Treasury trading

Automated trading and derivatives are changing the way US Treasuries are traded, exposing the buy side to high-frequency trading strategies. Chris Hall reports.

If big...

SEC proposes regulation of high-frequency trading firms in US Treasury market

US market regulator, the Securities and Exchange Commission (SEC), has proposed regulation of high-frequency trading (HFT) firms, also referred to as proprietary trading firms...

Charles River integrates with MTS BondsPro ATS

State Street’s Charles River Development, the order and execution management system (OEMS) provider, has completed integration of MTS BondsPro, an alternative trading system (ATS),...