Independent review finds no evidence of financial misconduct at CPIPG

Claims of financial misconduct made against CPI Property Group (CPIPG) by investment firm Muddy Waters, first raised in November 2023, have no evidence, an...

Tradeweb and FXall offer EM bond and FX swap workflow

Tradeweb and FXall have developed a solution – FX Swap Workflow – designed to help institutional investors trade emerging market (EM) products more efficiently...

Trumid adds RFQ to credit trading protocols

Electronic bond market operator Trumid, has launched new Request for Quote (RFQ) trading on its platform. Trumid clients can now initiate, view, and respond...

People: Hunter leaves MarketAxess; Louchard at AXA IM

Nichola Hunter has left MarketAxess as head of its rates business. Hunter joined the firm in 2020 when it acquired government bond marketplace LiquidityEdge,...

Why traders make better PMs

A new paper published by Gjergji Cici of the University of Kansas, with Philipp Schuster and Franziska Weishaupt, of the University of Stuttgart, has...

Long-term investors lean into equities

While long-term equities allocations continue to rise, Noel Dixon, senior macro strategist at State Street Global Markets, noted that: “weakness among fixed income is...

Guignot leads BNP credit e-trading in Europe

Alexandre Guignot has joined BNP Paribas CIB as head of credit e-trading in Europe.

BNP Paribas reported strong second quarter revenues in fixed income trading...

S&P Global: European bonds slump to lowest first-half volume since financial crisis

By Thomas Beeston

European high-yield bond issuance is set for the lowest first-half total since the global financial crisis, as volatile interest rates and fears...

The DESK Research: The state of liquidity for US mid-market asset management firms

In 2022, despite robust secondary trading volumes, many buy-side firms are citing worsening liquidity conditions and dealers have seen falling trading revenues moving into...

Subscriber

Sterling expands to cover fixed income securities

Order management, risk and margin technology provider Sterling Trading Tech will support fixed income securities by the end of Q2 2024, it has announced.

This...

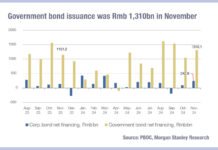

China government bond issuance reducing transparency of total social finance

Understanding state support for the economy in China can be measured across several dynamics, but debt provision to the non-financial private sector, known as...

US Treasuries: You can’t handle the truth

Editorial by Dan Barnes.

Nobody wants responsibility for the US Treasuries market. We checked.

In 2014 The DESK approached every US financial regulator and authority to...