KfW taps Boerse Stuttgart Digital for digital bond blockchain infrastructure

Boerse Stuttgart Digital, an infrastructure provider for cryptocurrencies and digital assets in Europe, now provides the technical infrastructure for KfW, for its new blockchain-based...

Bringing together fixed income trading and global youth empowerment: An emerging markets success story

Founded in 2000 by finance professionals who saw the social inequities in the emerging markets where they invested, EMpower supports hundreds of initiatives that...

BestEx Research launches no-code algo trading tool

BestEx Research Group, a provider of algorithmic execution and measurement solutions for equities, futures, and FX trading, has added a no-code algorithmic trading tool,...

Lin swaps BNP Paribas for TD Securities

TD Securities has appointed Yi Chi Lin as a director and US head of fixed income/FICC trade surveillance. He is based in New York.

Lin...

Enhancing trading through better surveillance

Trade surveillance, like best execution, can be harder to analyse in fixed income markets due to the complexity of instruments, access to data and...

Joel Kim of Dimensional Fund Advisors on corporate bond liquidity

With Joel Kim, Head of International Fixed Income and CEO Asia ex-Japan, Dimensional Fund Advisors.

Briefly describe Dimensional Fund Advisors, including its fixed income trading...

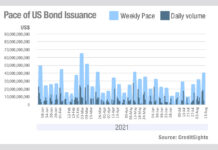

Is issuance for the high jump?

Data from CreditSights indicates the pace of US investment grade bond issuance fell from May, only to jump back in August, at a point...

Oliver Price joins Bank of America

Oliver Price has joined Bank of America as a GBP swaps trader in London.

Bank of America reported increased revenues for the fixed income, currencies...

Dagmar Kamber Borens takes on new role at State Street

State Street has appointed Dagmar Kamber Borens as head of global markets for continental Europe at State Street Bank International.

Based in Zurich, she reports...

Strategically automate and allocate to survive

There is a lot to be afraid of in the modern world. Geopolitical shocks, inflation and black swans abound, and the old ways do...

JP Morgan leads DCM amidst primary markets retreat in Q1 2025

In the first quarter of 2025, global debt capital markets (DCM) activity retreated while JP Morgan maintained its position at the top of the...

TISE sees bond listings bump thanks to rosy macro picture

The International Stock Exchange (TISE) listed 444 securities during the first half of 2024, an 18.4% increase against the same period last year.

The total...