WaveLabs signs up its first hedge fund client

WaveLabs, developer of the specialist fixed income trading technology, eLiSA, has signed up its first hedge fund client.

The eLiSA execution management system (EMS), created...

Can retail order flow impact institutional trading?

A new trend or only a one-off? Gherardo Lenti Capoduri, head of Market Hub & Umberto Menconi, head of Digital Markets Structures, Market Hub, talk...

ESMA launches consultation to clarify boundaries of trading venues under MiFID II

The European and Securities Market Authority (ESMA) has launched a consultation on what constitutes a trading venue, and what can be considered a trading...

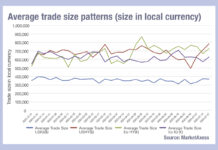

Not average: Trade sizes in 2024

Looking at the average trade sizes for high yield and investment grade bonds, across Europe and the US in 2024, we can see considerable...

Exclusive: David Nicol leaves LedgerEdge; Rutter steps forward in interim

David Nicol, co-founder of LedgerEdge, a distributed ledger-based fixed income trading venue, has left his position as CEO. Ian Chicken, chief operating officer at...

Greenwich predicts schism in European and US bond markets

By Vineet Naik.

European bond market structure is likely to diverge further from the US, as a result of the different investment models which are...

Yven Scholz promoted at Allianz Global Investors

Yven Scholz has been named head of electronic trading & services at Allianz Global Investors. Prior to his promotion, Scholz was a multi-asset derivatives...

ESMA “largely maintains approach” on MiFIR Review bond transparency

In the latest publication under the MiFIR Review, ESMA has issued its final report on bond transparency and reasonable commercial basis.

Changes have been made...

Global Investor Confidence Index decreased in February by 8.9 points

The Global Investor Confidence Index (ICI) decreased to 91.9, down 8.9 points from January’s revised reading of 100.8. The decline in investor confidence was...

Tradeweb files for IPO

Market operator Tradeweb Markets, has filed a registration statement on Form S-1 with the Securities and Exchange Commission (SEC) for a proposed initial public...

On The Desk: Carl James: On changing trader culture

Moving to a data-led model of trading requires a change in culture across the desk, as Pictet Asset Management’s head of Fixed Income Trading...

MarketAxess brings mid-point matching protocol to US credit

MarketAxess has launched its anonymous mid-point matching session protocol, Mid-X, in US credit.

Mid-X uses CP+, MarketAxess’s real-time predictive pricing engine for its global credit...