Consolidated tape: Can Europe replicate US market transparency?

Having spotted the need for a consolidated tape in 2005 – when the US already had one – Europe and the UK are so...

In 2021 we see record secondary markets trading for European Government Bonds

By Emile Figueiras, European Government Bond Product Specialist, MarketAxess

Secondary market volumes in European government bonds (EGBs) have grown significantly over the last 2 years....

Trading Intentions Survey 2017: US Focus

Firms with US credit desks are checking out Algomi, KCG Bondpoint and Trumid.

About the survey: The Trading Intentions Survey is conducted by The DESK, asking...

Subscriber

MarketAxess brings mid-point matching protocol to US credit

MarketAxess has launched its anonymous mid-point matching session protocol, Mid-X, in US credit.

Mid-X uses CP+, MarketAxess’s real-time predictive pricing engine for its global credit...

Sumitomo Mitsui Trust Asset Management adopts Bloomberg Rule Builder

Sumitomo Mitsui Trust Asset Management has adopted Bloomberg Rule Builder (RBLD), a multi-asset, rules-based trade automation tool, to try and enhance the efficiency and...

Chris Robinson joins Liquidnet

Liquidnet has appointed Chris Robinson as a multi-asset trader.

Robinson has more than a decade of industry experience, and joins Liquidnet from Louis Capital Markets.

Most...

Liquidnet reports ‘record’ $3.5bn volumes in Q1 2024

Liquidnet saw “record” trading volumes through its New Issue Trading (NIT) protocol, reaching US$3.5 billion, more than double the previous quarter.

The firm also saw...

UPDATE: Fed to end supplementary leverage ratio, talks down tapering

The federal bank regulatory agencies today announced that the temporary change to the supplementary leverage ratio, or SLR, for depository institutions issued on 2020,...

MTS launches dealer to client ticket protocol

MTS has introduced a new Dealer-to-Client Ticket (DCT) protocol on its BondVision platform, aiming to streamline trade workflows and reduce operational friction for both...

The high impact of low volumes in Q2

Volumes in US investment grade (IG) bonds have fallen significantly in the second quarter of this year compared with the same period in 2020....

Trading protocols: The pros and cons of getting a two-way price in fixed income

Getting a two-way price is unusual in fixed income trading, but normal in FX; that is changing and yielding some real results for best...

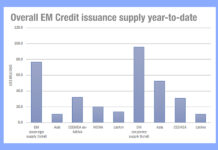

Issuance and inflows paint more positive picture for EM liquidity

Over the past week emerging markets (EM) credit issuance saw US$7.6 billion in newly issued bonds, against US£900k the week before, while on the...