The Agency Broker Hub: The fixed income ETD market – what are 2022’s main...

By Carmine Calamello, Head of Brokerage & Execution, Market Hub, Intesa Sanpaolo, IMI CIB Division.

After a decade of expansionary monetary policy and interest rates close...

Kapoor swaps BBVA for HSBC

Sonu Kapoor has joined HSBC as an emerging markets trader, based in New York.

HSBC’s corporate and institutional banking arm reported US$7.1 billion in revenues...

Trumid claims 33% market share growth in May

Trumid’s overall market share grew by a third in May, the firm has reported, with average daily volume (ADV) rising in tandem to US$5.2...

Banks’ Q2 fixed income revenues see modest increases over year

Banks’ second quarter 2024 fixed income revenues have seen modest to substantial increases, with Goldman Sachs an outlier, witnessing substantial drops in FICC intermediation...

Are issuers predicting a 6% Fed Funds rate?

Bond issuance has continued to beat expectations in February 2023. Last month saw 774 investment grade bonds issued globally, for a notional value of...

Arabadjief joins First Eagle

First Eagle Investments has appointed Justin Arabadjief as head of high grade trading for municipal credit as it continues to build out its investment...

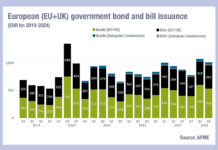

UK government debt issuance soars

The latest report from the Association for Financial Markets in Europe (AFME), looking at European government bond markets, found that €1 trillion of bonds...

Messaging tools spike as remote trading takes off

Providers of messaging tools used by portfolio managers, buy-side traders, sales traders and sell-side dealers have seen volumes spike as remote working becomes a...

TS Imagine poaches Villain from Itiviti

Frederic Villain has joined trading and risk technology provider TS Imagine, from trading platform supplier Itiviti.

“Happy to join a great team, under the leadership...

Derivatives : Exchange-traded products : Joel Clark

Why listed derivatives struggle to address risk

Some traders have been critical of listed products designed to replicate OTC derivatives, but exchanges are working hard...

How Fed bond buying is impacting markets

The Federal Reserve Bank of New York is hoovering up assets in order to support corporate borrowing in the US, and subsequently creating some...

Howell promoted at T Rowe Price

Matt Howell has been promoted to global head of trading strategy at T Rowe Price.

“I am looking forward to further developing our capabilities to...