Tradeweb steps into primary markets battle with InvestorAccess connection

Multi-asset market operator Tradeweb is collaborating with S&P Global Market Intelligence to introduce electronic connectivity between primary and secondary markets. The product scope currently...

Issuance up in lower rated debt

Analysis by Morgan Stanley’s team has found that, despite the slowing down of bond issuance globally in August, the higher levels of activity in...

Genesis launches web-based middle-office solution for fixed income trading

Genesis Global, a financial services software development company, has launched a web version of its multi-asset class middle-office solution, Trade Allocation Manager (TAM). Genesis...

Greenwich Associates: Buy side negative on CLOB for US treasuries

By Flora McFarlane.

Only 16% of buy-side firms thought using a central limit order book (CLOBs) would have a positive impact on trading US treasuries,...

Liquidnet Primary Markets launches for Europe and US

Liquidnet, the block trading specialist which is part of TP ICAP, has launched its hotly anticipated Liquidnet Primary Markets service, a new offering providing...

Gravis picks up Bloomberg AIM for front-office management

UK-based asset manager Gravis Capital Management has partnered with Bloomberg to support its future growth plans.

Bloomberg AIM, an order and investment management technology solution,...

Morningstar analysis shows fixed income funds under the cosh with thin liquidity

According to a new report from market data specialist, Morningstar, the unprecedented interest-rate hikes across developed markets has left most bond categories deep in...

LGAM bolsters London team

Legal & General Asset Management has made two appointments in its London office, with Ryan Lee named head of liquidity distribution and Euan Martin...

Tradeweb sees strong January; adds Jump Trading to European rates market

Tradeweb Markets has added Jump Trading to its European government bond marketplace to provide bank participants with streaming liquidity via the new Tradeweb EUGV...

Analysis: Market response to US Treasury’s increased borrowing needs

The US Treasury’s need to increase debt issuance, beyond market expectations, has had several effects. Firstly there was a ratings downgrade of the USA...

Insights & Analysis: “Lock in attractive yields as easing cycle continues,” UBS advises

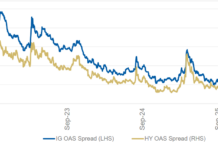

Trump’s election saw Treasury yields rise sharply but stabilise by the end of the week, with the VIX index dropping to its lowest since...

RBC BlueBay veteran Jewell joins Ninety One

Investment manager Ninety One has named Justin Jewell as co-portfolio manager for its developed markets specialist credit team.

He joins Darpan Harar in overseeing multi...