IMTC: Customising investment products efficiently in a rising rate environment

Technology is enabling investment managers to automate portfolio and instrument selection putting clients in the driving seat.

The DESK interviewed Russell Feldman, CEO of IMTC,...

FILS USA 2022: Leveraging technology to greater effect

The audience at FILS USA got an in-depth insight into optimising front office technology on Thursday, with a detailed analysis of how desktop interoperability...

Schleifer: “Explosive growth” for desktop interoperability as Finsemble goes solo

Cosaic is spinning off its desktop interoperability platform, Finsemble, following the sale of its Chart IQ to S&P Global, as a new company. The...

Chappell lands new trading role for 2020

Brett Chappell, the former head of fixed income trading at Nordea Investment Management, is joining Mariana UFP, a global financial services business in London...

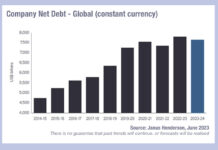

Issuance pushes outstanding global debt up 6.2%

Companies around the world took on US$456 billion of net new debt in 2022/23, as of 31 March 2023, pushing the outstanding total up...

FILS 2024: Differing views of the macro picture

Do the central banks have our backs? This question was debated by buyside strategists at the Fixed Income Leaders Summit on Friday.

“We believe in...

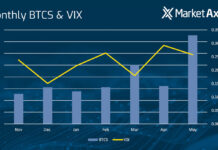

The Loan Lowdown: Volatility’s impact on Leveraged Loans

Howard Cohen, Head of Leveraged Loans at MarketAxess.

Since early April, the leveraged loan market has trended in one direction. Risk assets have continued to...

Research profile: Neptune shines bright

The DESK spoke with Byron Cooper-Fogarty, CEO of Neptune, to understand how it keeps delivering for buy-side users.

Axe streaming service, Neptune, has continued to...

Subscriber

Four drivers of Brazil’s increasingly complex corporate credit market

The Brazilian corporate credit market is becoming increasingly complex, and active bottom-up selection is essential for identifying winners and losers in this shifting environment.

That’s...

VedBrat named global head of trading for BlackRock

Supurna VedBrat, currently deputy head of trading and co-head for Electronic Trading & Market Structure at asset manager BlackRock will become global head of...

Sean Shanker swaps Citi for BTIG

Financial services firm BTIG has appointed Sean Shanker as a managing director for electronic trading.

In the New York-based role, Shanker will lead new initiatives...

ICE Bonds receives approval for expansion in Canada

Intercontinental Exchange (ICE), the market operator and data/technology provider has received approval to operate its ICE TMC fixed income trading platform in all Canadian...