SEC committee proposes bond issuance database for US credit

By Pia Hecher.

The Securities and Exchange Commission (SEC) Fixed Income Market Structure Advisory Committee (FIMSAC) has proposed that the SEC establish a new issue...

NowCM and Marketnode collaborate on digital APAC primary debt markets

NowCM Group and Marketnode have entered into an agreement to collaborate on the digitalisation of Asia-Pacific primary debt markets through a joint offering via...

FCA begins CTP tender process

The FCA has opened applications for the bond consolidated tape provider (CTP).

“ one of the final steps in the process to establish enhanced transparency...

Joseph Stewart named co-head fixed income at SocGen US

Joseph Stewart has started a new position as managing director, co-head of fixed income division for the Americas and head of flow sales for...

Smart deployment of tech is key to boost FI desk effectiveness

Mehmet Mazi, Managing Director and Head of Credit Trading at HSBC, gives his expert insight into optimising the trading desk.

Where are the greatest risks...

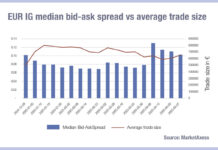

European bid-ask credit spreads not assuaged by tariff roll back

Liquidity costs in European corporate bond trading remain elevated, after the tariff shock in early April saw bid-ask spreads widen significantly across markets, according...

Outsourced trading consolidates further with State Street’s new acquisition

State Street Corporation has entered into a definitive agreement to acquire CF Global Trading, a global firm specialising in outsourced trading on an agency...

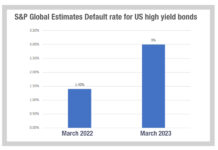

The enduring popularity of ‘Don’t Panic’

The phrase ‘Don’t Panic’ crops up frequently in comic fiction, notably in Douglas Adams’ book ‘Hitchhiker’s Guide to the Galaxy’ and in 1970’s British...

Tradeweb takes electronic credit trading lead, for second time

Multi-asset market operator, Tradeweb, has recorded average daily volume (ADV) of US$8.6 billion in US credit during February, surpassing rivals MarketAxess (US$8.5 billion) and...

This Week from Trader TV: Sarah Harrison, Allspring Global Investments

Shifting EU-US credit valuations, navigating data gaps, and the rise of portfolio trading

Sarah Harrison, senior portfolio manager at Allspring Global Investments, discusses the firm’s...

On The DESK : Nick Greenland : BNY Mellon Investment Management

Making the team.

Nicholas Greenland is managing director for APAC and EMEA, head of broker/dealer relationships for BNY Mellon Investment Management based in London. In...

ICE freezes bond indices until 30th April

The Intercontinental Exchange’s (ICE’s) ICE Data Indices (IDI) has postponed the rebalancing of all the ICE and ICE BofA indices for bond, preferred and...