‘HUB’ approach to buy-side middle and back office unites rivals

A new technology-led company, HUB, is being formed to build a cloud-based operating platform aimed at transforming asset managers’ operations technology.

The firm is being...

Steering through volatile markets

Madelaine Jones, portfolio manager for the European high yield and senior loan strategies at Oaktree Capital Management, talks to Lynn Strongin Dodds about lessons...

Research: Having an EMS does lead to better performance in bond trading

The buy-side’s wish-list for execution and order management systems revealed in The DESK’s latest research.

Buy-side bond traders want their trading technology to provide a...

Subscriber

Barclays: European portfolio trading to hit 18% in three years

Portfolio trading share in Europe’s investment grade market could get closer to that of the US from its current 10–12% level in volume to...

Marmoiton promoted at Alken

Alken Asset Management has promoted Antoine Marmoiton to head of its risk and trading team.

Based in London, Alken holds €1.5 billion in assets under...

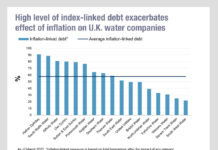

Examining the (Thames) Water fall

In 2013 when markets still looked precarious amid the fallout from the financial crisis, utilities were a good investment.

With a near cast-iron cashflow...

Subscriber

Best practice in credit TCA measures

The need to optimise execution quality is increased as buy-side firms seek to optimise all-to-all trading, and therefore price making, in credit. Transaction cost...

Goldman Sachs hit 12-year record for Global Markets in 2021

Goldman Sachs has seen its Global Markets division generate net revenues of US$22.08 billion, the highest annual net revenues in 12 years, which the...

Trading desk efficiency benchmark 2016

This primary research offers traders a view of trading operations within their peer group, to benchmark against their own.

This research is a snapshot of...

Subscriber

Oscar Kressner joins Millennium

Oscar Kressner has joined alternative asset manager Millennium Management Global Investment, as a portfolio manager covering global macro investing. Millennium, which has US$56 billion...

Corporate Bonds : Shuttering & Buffeting : Lynn Strongin Dodds

NETS CAST WIDE AS HIGH YIELD IS SPREAD THIN.

With Third Avenue and Lucidus putting high yield in the headlines, traders and portfolio managers are defining...

Nominate now for the European Markets Choice Awards 2023

To gain real recognition in the front office, put your best foot forward with a nomination in the European Markets Choice Awards 2023.

Recognising excellence...