Tradeweb launches AI pricing service for munis

Market operator Tradeweb has launched a new service, Tradeweb Ai-Price, which uses machine learning and proprietary data science to calculate daily prices for municipal...

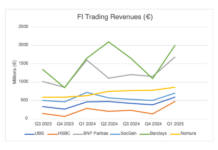

Barclays bounces with strong Q1 trading revenues

Fixed income trading revenues spiked in the first three months of the year at Barclays, putting the bank significantly ahead of the majority with...

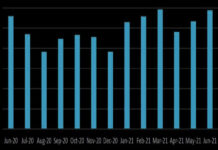

June sees European bond volume bounce back

European volumes in sovereign bonds traded in the secondary market continued to bounce back to its near 18-month peak, according to MarketAxess data, with...

BondAuction and NowCM partner to support primary market access

BondAuction and NowCM, the primary market platform, are establishing connectivity between their platforms to offer connectivity for respective clients and users.

NowCM and BondAuction will...

Bloomberg cracks?

By Josh Weinberger & Dan Barnes.

The famously holistic service has broken out the Instant Bloomberg chat function for non-terminal users, delivering what looks like...

On The Desk: Christine Kenny : Loomis Sayles

KNOWLEDGE AS AN ASSET (FROM DESK TO MANAGEMENT).

Christine Kenny, managing director, senior fixed income strategist, compliance officer and head of the London office at Loomis, Sayles...

State Street joins JPM digital debt platform

State Street has become the inaugural third-party custodian on JP Morgan’s digital debt service.

The digital debt service allows the issuance, settlement and servicing of...

Bond e-Trading prices still off; central banks adding to turmoil

Buy-side traders are still reporting “violent moves” in fixed income. In a liquidity crisis, investors are reliant on their asset managers’ traders to support...

This Week from Trader TV: Baillie Gifford: Tackling the complexities of cross-asset trading costs

Measuring cross-asset transaction cost analysis (TCA) and trade performance still faces major constraints, says Baillie Gifford’s Petros Kyliakoudis, with unique nuances and complexities across...

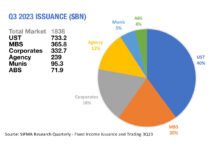

This! Is! What! Liquidity! Looks! Like!

In the past quarter, the average daily notional traded for US Treasuries was 99.5% of the total value of securities issued in the same...

The credit trading processes you really should have automated by now…

Automation has historically been highly challenging in corporate bond markets for several reasons, but traders say some parts of the workflow ‘ought’ to be...

Insights and analysis: Morgan Stanley 2025 – ‘Timing Is Everything’ across asset classes

Morgan Stanley’s outlook for 2025 finds a “still-moderate macro environment” with the mood heading towards deregulation, which it notes is largely is constructive for...