OTCX: Why you should support electronification of fixed income derivatives trading

Trading over-the-counter (OTC) derivatives poses fewer burdens that ever before, but buy-side support can accelerate progress.

The FILS Daily hears the pace of electronification in...

CSG closes portfolio financing, sells US$15 million in bonds

Real estate and renewable energy financial services company Churchill Stateside Group has sold US$15 million of short-term cash collateralised, tax-exempt bonds to financial institutions,...

State Street serves up ‘Cods and Chips’ in European bond market rigging case

State Street has helped to uncover chatrooms, including one called "Cods and Chips" that are alleged to have been used by sell-side traders to...

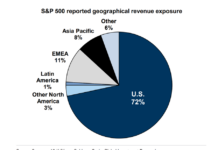

Insights and Analysis: Uncertainty reigns in trade war, rate impact expected

The inevitable effect of increased tariffs imposed by the US markets on trade partners – which may include the European Union, Canada and Mexico...

The evolving landscape of fixed income market data

Byron Cooper-Fogarty, CEO, Neptune Networks

The fixed income market continues to evolve at a pace I’ve not previously experienced in my 30 years in the...

When banks go bust holding boring bonds

**This article will appear in full in the next issue of The DESK**

Government bonds are described as a 'risk-free' instrument, on the basis that...

Clearlake Capital and Motive Partners to acquire BETA+ from LSEG

Private equity firms Clearlake Capital Group and Motive Partners have agreed to acquire the BETA+ assets from London Stock Exchange Group (LSEG), encompassing the...

Fixed income platforms buoyed as all-to-all expands

Fixed income electronic trading platform operators have announced record trading volumes in the first quarter of 2017.

MarketAxess, platform operator for dealer-to-client and all-to-all trading...

Overbond to integrate Euroclear LiquidityDrive into real-time bond trading automation

Overbond, the provider of AI quantitative analytics for institutional fixed income capital markets is to integrate Euroclear LiquidityDrive settlement-layer data for fixed income trade...

Analysis: Electronic trading across US and European bond markets

Electronic trading of US credit erupted in May 2024, according to analysis of the US credit market by Coalition Greenwich. It found that investment...

Subscriber

Balancing short and long term liquidity provision

Best execution on a trade-by-trade basis is too simplistic a measure of liquidity provision; The DESK looks at best practice for longer term liquidity...

OMS market: Vendors focusing on strategic sales pitch

Research suggests that an apparently limited interest in changing order management systems (OMS) on buy-side trading desks has been overcome by OMS vendors at...