JP MORGAN: The parametric approach to credit trading

Broadening the range and number of instruments traded in a single order is opening up liquidity.

The DESK spoke with Andreas Koukorinis, global head of...

Swinburne: Traders should beware of radical change in Europe

Brexit will mean that politics will take precedent over principal, when setting policy in Europe, warned Kay Swinburne MEP, speaking at the Fixed Income...

Market Analysis: Pressure on US dealing desks is changing priorities in 2020

New analysis of market activity this year has observed that while issuance is “racing toward historic annual highs” there is no corresponding increase in...

Greenwich Associates: Streaming prices boost buy-side bond liquidity in 2019

By Pia Hecher.

Market intelligence provider Greenwich Associates has announced this year’s market structure trends, reporting that markets will remain volatile and exchanges will become...

Subscriber

Brambilla swaps Morgan Stanley for Citi

Silvia Brambilla has joined Citi as a financials credit trader. She is based in London.

Citi reported US$4.3 billion in fixed income markets revenue for...

AFME and IA agree on UK consolidated bond tape

The Association for Financial Markets in Europe (AFME) has reached an agreement with the Investment Association (IA) on a proposal for a future UK...

ICE Bonds sees record notional volume for portfolio trading

Market operator, Intercontinental Exchange (ICE), has reported record volumes for fixed income portfolio trading during the fourth quarter of 2020.

Over US$1.9 billion in US-based...

Boltzbit: The practical application of AI in investment and trading

Asset managers are already able to leverage large language models to boost investment and trading workflows.

The DESK spoke with Yichuan Zhang, chief executive officer...

Symphony acquires StreetLinx

Symphony has acquired the counterparty mapping platform StreetLinx, thereby adding over 200 institutional counterparties to the 1000+ institutions it reports are currently using Symphony....

Sidi Shatku poached by BofA

SMBC’s former head of Emerging Markets (EM) Credit Trading in Europe, Middle East and Africa (EMEA), Sidi Shatku, has joined BofA’s EM credit trading...

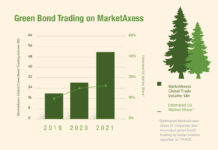

Trading for Trees

In 2019 MarketAxess launched their “Trading for Trees” program, under which five trees are planted by One Tree Planted, a partner charitable organization, for...

Will Pagano departure lead Citi to reset EM credit trading approach?

The departure of Marc Pagano, Citi’s managing director for emerging markets credit trading, has raised mixed feelings amongst buy-side traders. Although one in a...