MiFID II: New dealer economics

Explicit commission payments and a tabloid-style of attention-grabbing research are on the cards under MiFID II, as it reinvents investment economics in fixed income.

No-one...

Is issuance for the high jump?

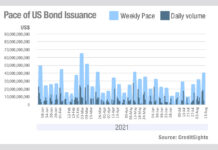

Data from CreditSights indicates the pace of US investment grade bond issuance fell from May, only to jump back in August, at a point...

Integrated value chain performs for LSEG

On 27 February, London Stock Exchange Group plc presented its 2024 preliminary results, with total income reaching £8.5 billion.

LSEG reported total income, excluding recoveries,...

Barclays Bank adopts CLS’s CCS service

Barclays Bank has gone live on CLS’s cross currency swaps (CCS) service.

The CCS service, an extension of the CLSSettlement payment-versus-payment settlement solution, mitigates settlement...

Broadridge preempts trader demands with BondGPT update

Broadridge has updated BondGPT to anticipate user queries and provide market data and insights based on their progression through the investment and trading workflow.

Through...

Research: OMS/EMS Survey 2022

Traders prioritise O/EMS analytics as liquidity dries up

OMS/EMS stacks need to help traders assess trading conditions in 2022.

The DESK’s research into buy-side execution and...

Subscriber

S&P Global Market Intelligence: MarketAxess collaboration to enhance fixed income market transparency and efficiency

Following the announcement of a new data partnership between S&P Global Market Intelligence and MarketAxess, Traders Magazine* sat down with Kat Sweeney, Head of...

Chaucer: Cost of insurance against defaults on sovereign debt jumps by 102%

The cost of insuring against sovereign debt defaults has increased by an average of 102% over the past year, according to research by global...

The Agency Broker Hub: An Italian story

The Italian Treasury has implemented a flexible and diversified funding policy to manage the amount of Italian public debt. Here Laura Maridati, Digital Markets...

Bloomberg, MarketAxess and Tradeweb Markets team up to tackle European consolidated tape

Bloomberg, MarketAxess and Tradeweb Markets today jointly issued the following statement:

“We are pleased to announce an initiative to jointly explore the delivery of a...

Fitch Group to acquire CreditSights

Rating and data provider Fitch Group is acquiring CreditSights, the provider of credit research to the global financial community.

The company is being acquired from...

MarketAxess reports record electronic trading volumes for January

By Flora McFarlane.

MarketAxess, electronic trading platform for fixed income securities, has reported that January was a record month for daily and monthly trading volumes,...