European Women in Finance : Else Braathen : A call to action

Else Braathen, risk domain manager at SimCorp talks to Lynn Strongin Dodds about risk management, stress testing and staying calm.

Although Covid-19 has shaken the...

Electronic credit platforms report fresh rises in trading volumes for March and Q1

Electronic bond market operators saw a new boost to volumes in March, and in the first quarter more broadly, as volatility in capital markets...

Markets Media Group acquires DerivSource

New York & London, October 5, 2021 – Leading U.S.-based digital financial news publisher Markets Media Group (MMG) is pleased to announce the acquisition of DerivSource, the...

Greenwich Associates: Buy side must break convention on fixed income EMS/OMS

A new report from analyst firm Greenwich Associates entitled, ‘The Fixed-Income Trading System Evolution’ makes a strong case for a new approach to developing...

The Book: Primary dealer positions climb rapidly, but concerns appear unfounded

Primary dealer positions of US Treasury holdings are expanding rapidly, but concern around restrictions on capacity are misplaced according to analysis.

A new paper by...

TransFICC investment to deliver e-trading platform with trader desktop

TransFICC, the specialist provider of low-latency connectivity and workflow services for fixed income and derivatives markets, has closed a Series A extension for US$17...

ESMA launches consultation to clarify boundaries of trading venues under MiFID II

The European and Securities Market Authority (ESMA) has launched a consultation on what constitutes a trading venue, and what can be considered a trading...

Adroit wins Invesco, connects to LedgerEdge

Adroit Trading Technologies, a trading system provider for institutional buy-side managers, has been mandated as an execution management system (EMS) across over the counter...

Origination: State Street issues US$2.25 billion in senior debt

State Street has issued US$2.25 billion in senior debt through State Street Bank and Trust. The bank has partnered with diverse and veteran-owned firms...

IHS Markit partners with Adroit to deliver multi-asset execution via thinkFolio

Investment services, risk and data management giant, IHS Markit, has partnered with Adroit Trading Technologies to give access to its multi-asset execution management capabilities...

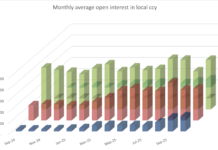

October credit futures’ activity cools after September busy roll month

In October trading volumes of credit futures at Eurex, Cboe global markets and CME cooled after the September roll month, but open interest continued...

Sourcing and connecting: The buy-side fixed income liquidity challenge

By Frank Cerveny, Head of Markets and Sales at MTS.

How can institutional investors find the liquidity to grow their fixed income businesses with the...