Yusuke Tanaka promoted at MUFG Trust

MUFG Trust has appointed Yusuke Tanaka as deputy general manager of its head office in Tokyo.

Tanaka has more than 23 years of industry experience,...

Municipal bond traders push for better execution

A standardised framework of processes could emerge from platform providers and regulators to support electronification.

In a market without infrastructure, common standards of behaviour and...

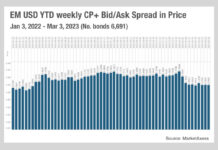

Emerging markets’ uneasy calm

Bid-ask spreads for fixed income trading in emerging markets have stabilised after a tumultuous year in 2022, according to TraX data, triggered by the...

Industry viewpoint : ETFs : Ganesh Iyer & Steve Mickle

ETFS: HOW THE BUY-SIDE TRADER BENEFITS FROM THE NETWORK EFFECT.

Fixed income exchange-traded funds (ETFs) are increasing in popularity amongst buy-side traders. To realise their...

FILS USA 2023: Fed has lost investors’ confidence in guidance

The Federal Reserve’s constant mistakes on forward guidance have lost the confidence of some buy-side firms in its ability to predict outlooks.

Speaking at...

FCA consulting on bond and derivative markets transparency reforms

The UK’s Financial Conduct Authority (FCA) is consulting on proposals to improve the transparency regime for bond and derivative markets.

The consultation, which is open...

SEC forms Fixed Income Market Structure Advisory Committee

By Flora McFarlane.

The Securities and Exchange Commission (SEC) has announced the formation and first members of its Fixed Income Market Structure Advisory Committee.

The committee,...

Sterling expands to cover fixed income securities

Order management, risk and margin technology provider Sterling Trading Tech will support fixed income securities by the end of Q2 2024, it has announced.

This...

Liquidnet launches primary bond market offering as buy side demands innovation

Block-trading specialist Liquidnet is launching into the primary market technology space. Its new electronic solution, Liquidnet Debt Capital Markets (DCM), is focused on new...

ECB widens €STR calculation data pool

The European Central Bank (ECB) is adding 24 banks to its euro short-term rate (€STR) calculation to boost the benchmark’s reliability.

The banks were added...

Investor Demand: IG private credit creates ‘attractive entry points’ for investors

Research by Aviva Investors has broken down the illiquidity premia paid via private debt markets, noting that it is improving for investors, even as...

Analysis: E-trading platforms see gains and losses in corporate bond market battle

Morgan Stanley analysis of the monthly reports from market operators Tradeweb and MarketAxess, has shown wins and losses in market share for both platforms.

Looking...