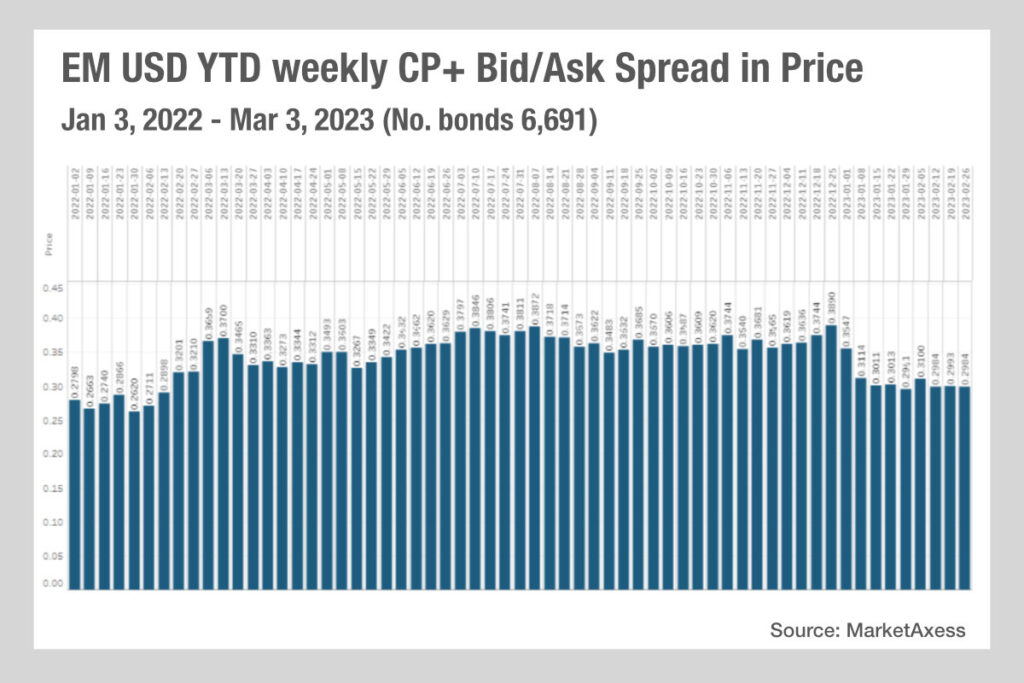

Bid-ask spreads for fixed income trading in emerging markets have stabilised after a tumultuous year in 2022, according to TraX data, triggered by the Russian invasion of Ukraine and the consequent economic effects.

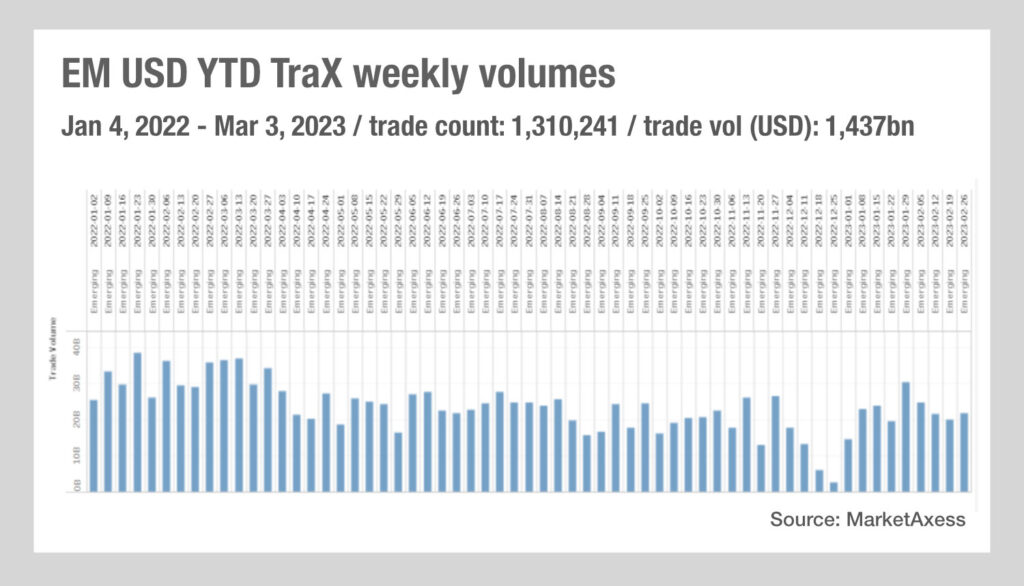

Trading volumes are still variable but reflect the range seen in the latter part of the year, after initial volatility had calmed. Consequently liquidity is looking more optimal and less expensive than the average for 2022, creating a better market for buy-side traders to get deals done. This positive trading environment is still at the mercy of the macros environment and with upcoming announcements on the US and Chinese economies having a major effect on shaping investment goals, there is plenty of potential for future movements ahead. Buy-side desks could take this opportunity to engage with cash bond markets while liquidity is more positive, rather than trading in non-cash instruments as an alternative.

In addition, this could be a chance to assess more efficient ways of accessing bonds – such as via electronic trading – in order to build data around those trading channels and assess execution quality. While bid-ask spreads in developed markets credit have been falling, EM has hit a level. There is the potential for them to fall further – as they did ahead of the invasion in 2022 – which could make liquidity even less expensive to access.

©Markets Media Europe 2023

©Markets Media Europe 2025