How asset managers capture micro-alpha opportunities

Setting up your desk correctly can help to boost returns for funds and clients.

When an opportunity arises for a fund to improve its returns,...

Rates : Fully automatic? : Dan Barnes

Market volatility may shift rates back to voice in 2019

If predicted volatility pushes firms towards voice trading next year, rates traders will suffer from...

Liquidnet expands continental Europe coverage

Block trading specialist Liquidnet, part of the TP ICAP Group, has expanded its continental European coverage by deploying specialists in equities and fixed income...

The week in summary: Credit Suisse; fixed income liquidity; ‘Who died?’

This week has been very challenging for buy-side trading desks as broker-dealers struggle to price bonds, and uncertainty gripped markets.

“I was off Monday, came...

What do shorter durations imply for trading?

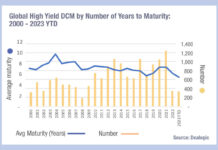

Data from Dealogic shows that the average maturity for newly issued bonds has been falling in 2023 relative to recent years, with the current...

Raiffeisen partners with AxeTrading and Integral to boost bond trading efficiency

Raiffeisen Bank International (RBI) has partnered with AxeTrading, the fixed income trading software company, and Integral, the FX technology provider, to deliver a new...

Market reflects grim situation in Ukraine

The invasion of Ukraine on 24 February 2022 by Russia, wedded to subsequent sanctions and travel restrictions have triggered a series of market responses...

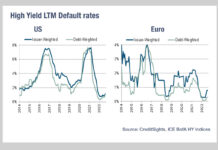

Less distressed debt

The risks of default in high yield credit are one reason cited for reduced sell-side trading activity in the asset class. However, while the...

EWIFA Crystal Ladder Winner: Amber Wright

European Women in Finance, Crystal Ladder winner Amber Wright, is Global Head of Fixed Income & E-Trading at RJ O’Brien and discusses maths, efficiency...

Liontrust promotes McLoughlin and Hendry

Matthew McLoughlin (see profile here), partner and head of trading at Liontrust Asset Management, has been promoted to chief commercial officer, in addition to...

Chinese corporates on agenda for Bloomberg Barclays Global Aggregate Index

Corporate bond inclusion is going to be on the agenda for this year's Index Advisory Council, Bloomberg has confirmed, following the inclusion of Chinese...

Nasdaq reports seven-year error in closing auction

Story updated 16.00 BST 30/8/18

In a Trader Alert published at 08.30 ET, on 30 August 2018, updating a previous notice published on Friday 24...