John Orrock joins Cowen fixed income outsourced trading

Cowen has expanded its fixed income outsourced trading team with the appointment of John Orrock as managing director. He will be based in the...

Invesco global head of fixed income trading Glenn Taitz departs for Adroit

Invesco’s global head of fixed income trading, Glenn Taitz, has left the firm to take up the position of head of business operations at...

Trading Technologies acquires AxeTrading

Trading Technologies, the capital markets technology platform provider, has acquired London-based AxeTrading, provider of fixed income trading solutions.

The acquisition marks a broadening of TT’s...

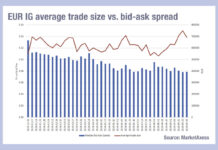

Is European credit electronification bouncing back?

There has been a noted proportional increase in electronification of US credit trading, as tracked by Coalition Greenwich. However, metrics around European trading found...

SIFMA finds support for shift in benchmarking of 20-year US corporate bonds

The spread for many legacy 20-year US corporate bonds is benchmarked against the 30-year Treasury, but trade body SIFMA has found support for moving...

FILS 2022: Repo market not broken but can do better

Liquidity problems shone a light on the effectiveness of the repo market in recent months, speakers acknowledged at this year’s Fixed Income Leaders' Summit...

Nasdaq reports seven-year error in closing auction

Story updated 16.00 BST 30/8/18

In a Trader Alert published at 08.30 ET, on 30 August 2018, updating a previous notice published on Friday 24...

Disruption without interruption

David Parker, Head of MTS Markets International (MMI) discusses tapping into the benefits of fixed income trading technology.

Technological advancements are quietly – and sometimes...

Johnson Chui to lead HKEX global issuer services

Hong Kong Exchanges and Clearing Limited (HKEX) has appointed Johnson Chui as managing director and head of global issuer services, effective 2nd September.

In the...

DBS joins LCH SwapClear as the first direct member in Singapore

DBS Bank has joined SwapClear, part of LCH, the clearing business for London Stock Exchange Group (LSEG) business. The bank has become the first...

Etrading Software and Artis Holdings’ electronic loans platform is live

Capital markets system provider Etrading Software, and electronic loans technology specialist Artis Holdings, have completed the opening bids wanted in competition (BWIC) process via...

Instinet veteran flips to Liquidnet

Liquidnet has appointed Mark Turner as managing director and co-head of sales and trading for the Americas.

Turner has been a managing director at Instinet...