Wave Labs’ eLiSA successfully executes first ever trade with Groupama Asset Management

Wave Labs, a provider of credit execution solutions, has successfully executed its first ever trade on its Electronic Liquidity Seeking Application (eLiSA) with Groupama...

Trading: How to find liquidity in a drought

When market makers offer no bids for corporate bond trades, buy-side traders need to get creative.

Dealers are the main source of liquidity in the...

Trade associations urge EU to ditch ‘uncompetitive’ active account requirement proposal

A number of trade associations have urged EU policymakers to delete the proposed Active Account Requirement, under the European Market Infrastructure Regulation (EMIR 3.0).

The...

Vis Nayar named global CIO equities at HSBC AM

Vis Nayar has been promoted to global chief investment officer for equities at HSBC Global Asset Management.

Having started his career at KPMG, he...

Paolo Buscaglia swaps UniCredit for Santander

Santander Corporate & Investment Banking has appointed Paolo Buscaglia as co-head of European government bond (EGB) and sovereign, supranational and agency debt (SSA) trading....

The case for deferring reports of larger trades

The Association for Financial Markets in Europe (AFME) has published study consolidating fixed income trading data from numerous sources for the period of March...

Technology: The real reason you cannot get a new trading system

Lynn Strongin Dodds investigates the barriers to adopting new technology.

Technological advances may be developing at breakneck speed but many of the barriers of adoption...

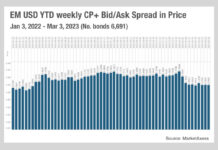

Emerging markets’ uneasy calm

Bid-ask spreads for fixed income trading in emerging markets have stabilised after a tumultuous year in 2022, according to TraX data, triggered by the...

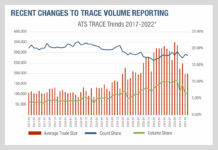

What FINRA’s trade reporting changes tell us about consolidated tapes

Understanding the difference between commercial and public data offerings is crucial for data users. A good example of this difference can be found with...

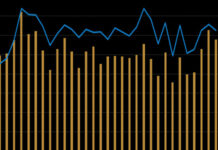

Get US high yield portfolios in order over summer

June looked decidedly challenging for US high yield (HY) trading, as mean bid-ask (BA) spreads dislocated from the median, indicating spikes in BA spreads...

Data and diversification key to solving liquidity woes

The market is fond of complaining about the lack of liquidity in markets. But panellists at this year’s FILS Europe argued that there is...

Bond issuance standardisation boosted by FMSB

Market participants have published final guidelines that clarify expected behaviour during the new issue process for fixed income bonds in Europe.

A series of measures...